At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

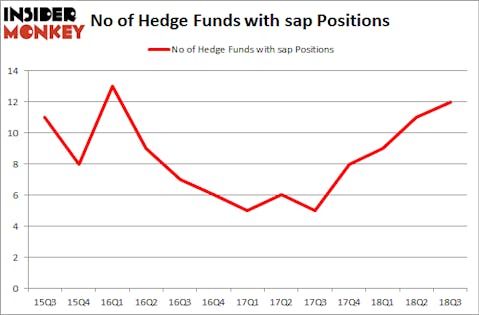

SAP SE (NYSE:SAP) has seen an increase in enthusiasm from smart money lately. Our calculations also showed that sap isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s analyze the new hedge fund action regarding SAP SE (NYSE:SAP).

Hedge fund activity in SAP SE (NYSE:SAP)

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in SAP at the beginning of this year. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the largest position in SAP SE (NYSE:SAP). Fisher Asset Management has a $831 million position in the stock, comprising 1% of its 13F portfolio. Coming in second is Soroban Capital Partners, led by Eric W. Mandelblatt and Gaurav Kapadia, holding a $585.4 million position; 8.9% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, D. E. Shaw’s D E Shaw and Jeffrey Talpins’s Element Capital Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most valuable position in SAP SE (NYSE:SAP). Marshall Wace LLP had $2.2 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $0.8 million investment in the stock during the quarter. The only other fund with a brand new SAP position is Frederick DiSanto’s Ancora Advisors.

Let’s go over hedge fund activity in other stocks similar to SAP SE (NYSE:SAP). These stocks are PetroChina Company Limited (NYSE:PTR), Unilever plc (NYSE:UL), Unilever N.V. (NYSE:UN), and DowDuPont Inc. (NYSE:DWDP). This group of stocks’ market caps match SAP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PTR | 14 | 170267 | 0 |

| UL | 14 | 137235 | 1 |

| UN | 14 | 1117559 | 0 |

| DWDP | 69 | 4551261 | -6 |

| Average | 27.75 | 1494081 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.49 billion. That figure was $1.66 billion in SAP’s case. DowDuPont Inc. (NYSE:DWDP) is the most popular stock in this table. On the other hand PetroChina Company Limited (NYSE:PTR) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks SAP SE (NYSE:SAP) is even less popular than PTR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.