Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 900 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about The Boston Beer Company Inc (NYSE:SAM).

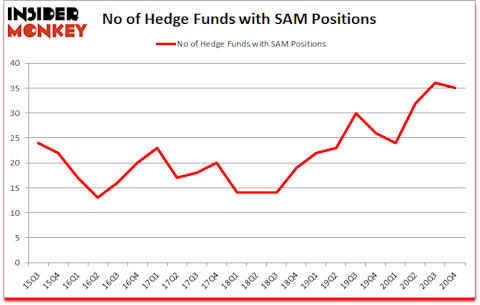

Is SAM stock a buy? The Boston Beer Company Inc (NYSE:SAM) was in 35 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 36. SAM shareholders have witnessed a decrease in hedge fund interest in recent months. There were 36 hedge funds in our database with SAM positions at the end of the third quarter. Our calculations also showed that SAM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Noam Gottesman of GLG Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to view the key hedge fund action encompassing The Boston Beer Company Inc (NYSE:SAM).

Do Hedge Funds Think SAM Is A Good Stock To Buy Now?

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in SAM a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in The Boston Beer Company Inc (NYSE:SAM), which was worth $371.4 million at the end of the fourth quarter. On the second spot was Citadel Investment Group which amassed $136.8 million worth of shares. Fisher Asset Management, Marshall Wace LLP, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Stamina Capital Management allocated the biggest weight to The Boston Beer Company Inc (NYSE:SAM), around 3.39% of its 13F portfolio. Kehrs Ridge Capital is also relatively very bullish on the stock, dishing out 2.89 percent of its 13F equity portfolio to SAM.

Because The Boston Beer Company Inc (NYSE:SAM) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedgies that decided to sell off their positions entirely heading into Q1. At the top of the heap, John Armitage’s Egerton Capital Limited sold off the biggest position of the “upper crust” of funds followed by Insider Monkey, totaling about $108.2 million in stock. William B. Gray’s fund, Orbis Investment Management, also sold off its stock, about $79.7 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 1 funds heading into Q1.

Let’s also examine hedge fund activity in other stocks similar to The Boston Beer Company Inc (NYSE:SAM). These stocks are Wynn Resorts, Limited (NASDAQ:WYNN), Graco Inc. (NYSE:GGG), Qiagen NV (NASDAQ:QGEN), Atmos Energy Corporation (NYSE:ATO), Booz Allen Hamilton Holding Corporation (NYSE:BAH), PPD, Inc. (NASDAQ:PPD), and IPG Photonics Corporation (NASDAQ:IPGP). All of these stocks’ market caps are similar to SAM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WYNN | 52 | 1104483 | 9 |

| GGG | 25 | 269383 | -5 |

| QGEN | 24 | 670099 | -5 |

| ATO | 25 | 274618 | 7 |

| BAH | 27 | 305001 | -4 |

| PPD | 29 | 703701 | -4 |

| IPGP | 25 | 522346 | 1 |

| Average | 29.6 | 549947 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.6 hedge funds with bullish positions and the average amount invested in these stocks was $550 million. That figure was $1144 million in SAM’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Qiagen NV (NASDAQ:QGEN) is the least popular one with only 24 bullish hedge fund positions. The Boston Beer Company Inc (NYSE:SAM) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SAM is 52.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7.9% in 2021 through April 1st and still beat the market by 0.4 percentage points. Hedge funds were also right about betting on SAM as the stock returned 19.1% since the end of Q4 (through 4/1) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Boston Beer Co Inc (NYSE:SAM)

Follow Boston Beer Co Inc (NYSE:SAM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.