The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH).

Is Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) an outstanding investment today? Investors who are in the know are taking an optimistic view. The number of long hedge fund positions went up by 1 recently. Our calculations also showed that ruth isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to analyze the key hedge fund action regarding Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH).

What have hedge funds been doing with Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH)?

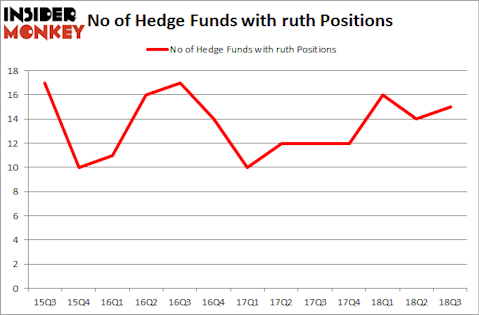

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in RUTH over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH), with a stake worth $13 million reported as of the end of September. Trailing AQR Capital Management was GLG Partners, which amassed a stake valued at $11.7 million. Arrowstreet Capital, Citadel Investment Group, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, created the largest position in Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH). PEAK6 Capital Management had $0.7 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $0.2 million position during the quarter. The only other fund with a brand new RUTH position is Frederick DiSanto’s Ancora Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) but similarly valued. We will take a look at Tekla Healthcare Investors (NYSE:HQH), Republic Bancorp, Inc. (NASDAQ:RBCAA), Cerus Corporation (NASDAQ:CERS), and Wins Finance Holdings Inc. (NASDAQ:WINS). All of these stocks’ market caps resemble RUTH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HQH | 1 | 215 | 0 |

| RBCAA | 7 | 18489 | 0 |

| CERS | 18 | 134867 | 2 |

| WINS | 1 | 838 | 0 |

| Average | 6.75 | 38602 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $54 million in RUTH’s case. Cerus Corporation (NASDAQ:CERS) is the most popular stock in this table. On the other hand Tekla Healthcare Investors (NYSE:HQH) is the least popular one with only 1 bullish hedge fund positions. Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CERS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.