While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Ross Stores, Inc. (NASDAQ:ROST).

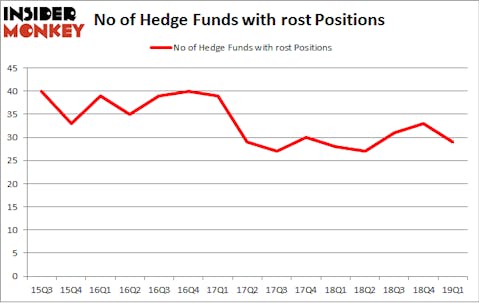

Is Ross Stores, Inc. (NASDAQ:ROST) a buy, sell, or hold? The best stock pickers are turning less bullish. The number of bullish hedge fund positions dropped by 4 recently. Our calculations also showed that rost isn’t among the 30 most popular stocks among hedge funds. ROST was in 29 hedge funds’ portfolios at the end of the first quarter of 2019. There were 33 hedge funds in our database with ROST holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the recent hedge fund action encompassing Ross Stores, Inc. (NASDAQ:ROST).

What have hedge funds been doing with Ross Stores, Inc. (NASDAQ:ROST)?

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in ROST a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Ross Stores, Inc. (NASDAQ:ROST), which was worth $304.4 million at the end of the first quarter. On the second spot was Adage Capital Management which amassed $228.4 million worth of shares. Moreover, Third Point, D E Shaw, and Alyeska Investment Group were also bullish on Ross Stores, Inc. (NASDAQ:ROST), allocating a large percentage of their portfolios to this stock.

Because Ross Stores, Inc. (NASDAQ:ROST) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few hedge funds that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Brandon Haley’s Holocene Advisors sold off the biggest stake of all the hedgies watched by Insider Monkey, totaling close to $73.8 million in stock. Alexander Mitchell’s fund, Scopus Asset Management, also dropped its stock, about $25.9 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 4 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Ross Stores, Inc. (NASDAQ:ROST). These stocks are Ford Motor Company (NYSE:F), V.F. Corporation (NYSE:VFC), SYSCO Corporation (NYSE:SYY), and Barclays PLC (NYSE:BCS). This group of stocks’ market values are closest to ROST’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| F | 33 | 1106452 | 0 |

| VFC | 29 | 1091453 | 2 |

| SYY | 36 | 2944902 | 2 |

| BCS | 10 | 160567 | 0 |

| Average | 27 | 1325844 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $1326 million. That figure was $907 million in ROST’s case. SYSCO Corporation (NYSE:SYY) is the most popular stock in this table. On the other hand Barclays PLC (NYSE:BCS) is the least popular one with only 10 bullish hedge fund positions. Ross Stores, Inc. (NASDAQ:ROST) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ROST, though not to the same extent, as the stock returned -0.2% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.