We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of RLI Corp. (NYSE:RLI) based on that data.

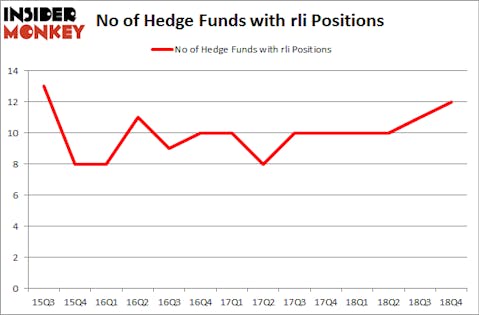

RLI Corp. (NYSE:RLI) has experienced an increase in enthusiasm from smart money recently. RLI was in 12 hedge funds’ portfolios at the end of December. There were 11 hedge funds in our database with RLI positions at the end of the previous quarter. Our calculations also showed that rli isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to go over the fresh hedge fund action surrounding RLI Corp. (NYSE:RLI).

How have hedgies been trading RLI Corp. (NYSE:RLI)?

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RLI over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Markel Gayner Asset Management held the most valuable stake in RLI Corp. (NYSE:RLI), which was worth $82.6 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $22.3 million worth of shares. Moreover, Polar Capital, Renaissance Technologies, and GLG Partners were also bullish on RLI Corp. (NYSE:RLI), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, established the most valuable position in RLI Corp. (NYSE:RLI). Renaissance Technologies had $7.8 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also made a $1.1 million investment in the stock during the quarter. The only other fund with a new position in the stock is Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks similar to RLI Corp. (NYSE:RLI). We will take a look at Dicks Sporting Goods Inc (NYSE:DKS), Merit Medical Systems, Inc. (NASDAQ:MMSI), Blackbaud, Inc. (NASDAQ:BLKB), and Tech Data Corp (NASDAQ:TECD). All of these stocks’ market caps match RLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DKS | 22 | 168865 | 1 |

| MMSI | 18 | 207217 | 6 |

| BLKB | 13 | 57776 | 0 |

| TECD | 23 | 191630 | 3 |

| Average | 19 | 156372 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $156 million. That figure was $142 million in RLI’s case. Tech Data Corp (NASDAQ:TECD) is the most popular stock in this table. On the other hand Blackbaud, Inc. (NASDAQ:BLKB) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks RLI Corp. (NYSE:RLI) is even less popular than BLKB. Hedge funds dodged a bullet by taking a bearish stance towards RLI. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately RLI wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); RLI investors were disappointed as the stock returned 14.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.