The health store sector isn’t showing signs of recovery; revenues of leading drugstore chains remained stable as in the case of Walgreen Company (NYSE:WAG) or slightly declined as in the case of Rite Aid Corporation (NYSE:RAD). And yet these companies’ stocks continue to trade up. The company that led the charge in the stock market in recent months was Rite Aid as its stock spiked by more than 91%. Will the company continue to rally?

Health Care Sector Continues to Contract

The drop in sales for the sector in the past month is also reflected in Rite Aid’s recent sales report that showed a 4% drop in store sales (y-o-y).

Rite Aid Turning a Profit

One the reasons that may have contributed to the rally of Rite Aid in the stock market is it’s turning a profit in the past couple of quarters after losing in recent years. But is turning from red to black enough to convince shareholders that the company is on its road to recovery?

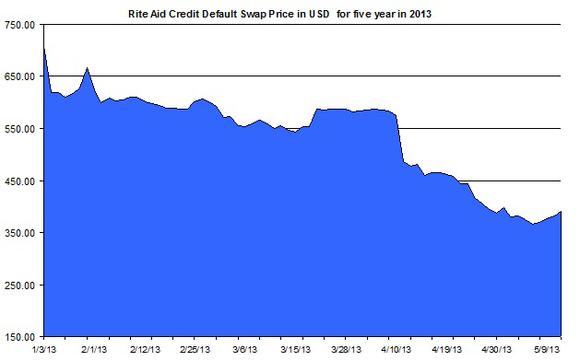

Rite Aid CDS continue to fall

The company’s credit default swap (five years, in US dollar) has tumbled down during the year: it has decreased from nearly 710 back at the beginning of 2013 to nearly 390 as of the start of last week. The current price of 390 means the annual premium is $390,000 in case the company will default $10 million of its debt within the next five years. The tumble in the CDS is another indication the company is regaining the confidence of both bondholders and shareholders.

The chart below shows the developments of the five-year CDS price during 2013 (daily prices).

How is Rite Aid doing compared to other leading drugstore chains? In the first quarter of 2013, Rite Aid’s revenues fell by 9.7% (y-o-y). One of the reasons for the sharp drop in sales is because in Q1 2012 there were 14 weeks and not 13 weeks as there are in 2013. After controlling for this issue, the company’s revenues fell by only 2.7%.

In comparison, Walgreen’s revenues remained unchanged in the first quarter of 2013. But Walgreen’s, unlike Rite Aid, increased its sales in April by 3.8%. Moreover, Walgreen’s operating profitability grew by 10% and reached 6.5% in the first quarter of 2013.

Revenues of CVS Caremark Corporation (NYSE:CVS), much like Walgreen’s, remained virtually unchanged in the first quarter of 2013 as it inched down by 0.1% in Q1 2013. The company’s operating profitability sharply increased in the first quarter by 21% and reached 5.5%. These two companies also have a much better financial situation in terms of debt: Walgreen’s and CVS’s debt to equity ratio are 0.34 and 0.25, respectively. Conversely, Rite Aid still has a deficit in its equity.

Another advantage CVS and Walgreen have over Rite Aid is that the two former companies also offer dividend. Currently, CVS’s annual dividend yield is 1.5%; Walgreen’s annual dividend yield is 2.2%.

Take Away

Despite Rite Aid’s rise in profitability and its regained stability, the company is still dragging far behind other drug stores chains. I think the company’s deficit in equity, the ongoing fall in revenues, and the moderate decline in the health stores sector should steer investors away from this company.

The article Will Rite Aid’s Rally Continue? originally appeared on Fool.com and is written by Lior Cohen.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.