At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

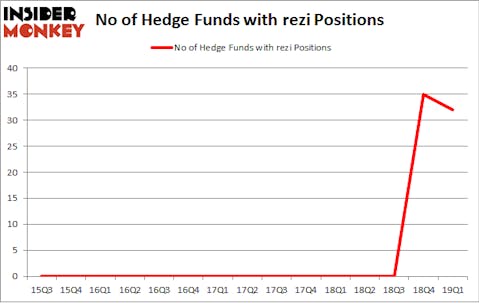

Is Resideo Technologies, Inc. (NYSE:REZI) undervalued? The smart money is becoming less hopeful. The number of long hedge fund positions decreased by 3 lately. Our calculations also showed that rezi isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the fresh hedge fund action surrounding Resideo Technologies, Inc. (NYSE:REZI).

What does the smart money think about Resideo Technologies, Inc. (NYSE:REZI)?

Heading into the second quarter of 2019, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in REZI a year ago. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Resideo Technologies, Inc. (NYSE:REZI) was held by Praesidium Investment Management Company, which reported holding $77.4 million worth of stock at the end of March. It was followed by Freshford Capital Management with a $59.8 million position. Other investors bullish on the company included Carlson Capital, D E Shaw, and Governors Lane.

Because Resideo Technologies, Inc. (NYSE:REZI) has witnessed declining sentiment from the smart money, logic holds that there exists a select few hedge funds that decided to sell off their full holdings last quarter. Intriguingly, Kenneth Mario Garschina’s Mason Capital Management sold off the largest stake of the 700 funds watched by Insider Monkey, valued at an estimated $56 million in stock. Frank Brosens’s fund, Taconic Capital, also sold off its stock, about $7.7 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Resideo Technologies, Inc. (NYSE:REZI) but similarly valued. We will take a look at II-VI, Inc. (NASDAQ:IIVI), Sogou Inc. (NYSE:SOGO), MGE Energy, Inc. (NASDAQ:MGEE), and Penn National Gaming, Inc (NASDAQ:PENN). This group of stocks’ market valuations match REZI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IIVI | 22 | 115512 | 0 |

| SOGO | 8 | 6859 | 2 |

| MGEE | 9 | 34318 | -3 |

| PENN | 24 | 263918 | 6 |

| Average | 15.75 | 105152 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $105 million. That figure was $393 million in REZI’s case. Penn National Gaming, Inc (NASDAQ:PENN) is the most popular stock in this table. On the other hand Sogou Inc. (NYSE:SOGO) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Resideo Technologies, Inc. (NYSE:REZI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on REZI as the stock returned 3.7% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.