Research In Motion Ltd (NASDAQ:BBRY) is slowly regaining investors’ trust as its stock begins recovering. The company’s new line of smartphones is also augmenting its sales in recent months. Does this mean the company still undervalued? Is it time to consider buying the company’s stock?

BlackBerry’s financial reports

The company’s second quarter report (for the quarter ending May) will come out on Friday, June 28. Many expect the company’s revenue to rise mainly due to sales of BlackBerry 10. In that case, sales will increase for the first time in three quarters. The current projections are that the company delivered nearly 7.7 million smartphones in the recent quarter. In the past five quarters, Research In Motion Ltd (NASDAQ:BBRY)’s number of deliveries fell. If the projections are correct, this will bring the number of smartphones sold to a similar rate as in the first quarter of fiscal year 2013.

Out of the 7.7 million of devices sold, nearly 3.5 million are expected to be from Z10 and Q10 units. In other words, nearly half of the company’s sales came from its new line of smartphones. Some analysts expect the company will sell more than 14 million units of the BlackBerry 10 line this fiscal year. This sharp rise in sales isn’t common for Research In Motion Ltd (NASDAQ:BBRY) in recent years. Other leading smartphone companies are used to seeing this kind of high growth in revenue: In the first of 2013, Apple Inc. (NASDAQ:AAPL)‘s net revenue rose by nearly 11.2% (year-over-year).

Will BlackBerry’s rise in sales persist over time? Does it match the market average?

So is the company really recovering?

The company is sure making efforts to turn its situation around: It signed a deal with Verizon to launch BlackBerry Z10 – the new line of smartphones under Research In Motion Ltd (NASDAQ:BBRY)’s new OS.

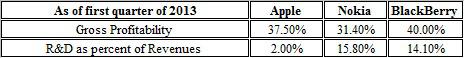

The company’s research and development provision remains high as a percent of revenue. The table below summarizes the figures for Apple Inc. (NASDAQ:AAPL), BlackBerry and Nokia Corporation (ADR) (NYSE:NOK).

As seen, Nokia and BlackBerry lead the way with a much higher R&D out of revenue percentage than Apple Inc. (NASDAQ:AAPL)’s. Moreover, Nokia’s R&D provision reached nearly $1.2 billion in the first quarter of 2013. In comparison, Apple’s provision was only $880 million. This shows that struggling companies such as Nokia and BlackBerry are investing a lot to regain their market share.

Furthermore, Research In Motion Ltd (NASDAQ:BBRY)’s gross profitability is slightly higher than Apple’s. This is another strong point for the company. If it can keep its high profit margin, it could translate to a higher valuation.

Despite BlackBerry’s expected rise in revenue, this rally didn’t translate to a higher market share in the smartphone market: Based on Comscore’s recent market research, BlackBerry’s platform market share fell by 0.8% during the recent quarter to reach 5.1%. On the other hand, Apple’s market share rose by 1.4% to reach 39.2%. Nokia’s Symbian remained flat at 0.5%. Nokia Corporation (ADR) (NYSE:NOK) also uses Microsoft’s OS, which remained virtually unchanged at 3%. Therefore, despite the great strides both Nokia Corporation (ADR) (NYSE:NOK) and BlackBerry have made in recent months, their market share didn’t rise.

This could suggest that Research In Motion Ltd (NASDAQ:BBRY)’s rise in sales barely matched the smartphone market growth in sales.

With these facts in mind, let’s turn to examine the company’s valuation.

BlackBerry’s valuation

The main issue that many analysts put as an advantage for holding BlackBerry’s stock is that the company’s market value of $7.6 billion is basically BlackBerry’s current assets, which stand on $7.1 billion. Further, the current value doesn’t take into account any potential growth the company may have in the coming months. Therefore, the risk of holding this company’s stock at its current rate is low.

Considering the company has no debt, its equity in the balance sheet is nearly $9.5 billion, and its recent rise in sales, there is a grain of truth to this assessment. Moreover, Research In Motion Ltd (NASDAQ:BBRY) is in a better position than other struggling companies such as Nokia, which has a debt-to-equity ratio of 0.7. But I don’t think these facts are enough to persuade us to buy shares of BlackBerry.

Let’s start by saying that buying a company for its assets at market price isn’t much of a bargain. Second, BlackBerry may start losing money as it did last year. This will cut down on the company’s assets, which will bring its value down. Third, some of the company’s current assets, such as inventory, may diminish in value over time. The main selling point shouldn’t be the company’s low value but its potential recovery and its performance compared to other companies in its industry. After all, if the company won’t be able to turn it around, then its value will continue to dwindle.

Based on the above, we see that the company is showing signs of recovery and is likely to augment its sales. But since the company’s market share continues to dwindle, this suggests its growth is below the market average.

The foolish bottom line

I think Research In Motion Ltd (NASDAQ:BBRY) is on its road to recovery and is likely to keep seeing a rise in its stock. Moreover, the current market price might be still undervalued; perhaps after the publication of the quarterly reports this will change. But at the same time, BlackBerry’s potential growth over time is still questionable and until it starts to increase its market share, BlackBerry’s value will remain not much higher than its current price.

The article Is BlackBerry Still Undervalued? originally appeared on Fool.com and is written by Lior Cohen.

Lior Cohen has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple. Lior is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.