It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 24.4% during the first 9 months of 2019 and outperformed the S&P 500 ETF by 4 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Regenxbio Inc (NASDAQ:RGNX) changed during the first quarter.

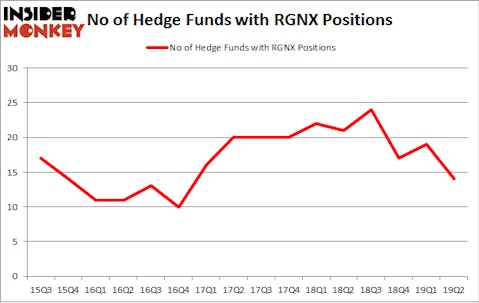

Regenxbio Inc (NASDAQ:RGNX) was in 14 hedge funds’ portfolios at the end of June. RGNX shareholders have witnessed a decrease in hedge fund interest of late. There were 19 hedge funds in our database with RGNX holdings at the end of the previous quarter. Our calculations also showed that RGNX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the recent hedge fund action encompassing Regenxbio Inc (NASDAQ:RGNX).

How have hedgies been trading Regenxbio Inc (NASDAQ:RGNX)?

Heading into the third quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -26% from the previous quarter. By comparison, 21 hedge funds held shares or bullish call options in RGNX a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Regenxbio Inc (NASDAQ:RGNX) was held by Redmile Group, which reported holding $71.5 million worth of stock at the end of March. It was followed by Water Street Capital with a $51.4 million position. Other investors bullish on the company included Perceptive Advisors, Renaissance Technologies, and Balyasny Asset Management.

Seeing as Regenxbio Inc (NASDAQ:RGNX) has witnessed bearish sentiment from the smart money, it’s easy to see that there was a specific group of funds that slashed their positions entirely last quarter. At the top of the heap, Jacob Doft’s Highline Capital Management cut the biggest position of all the hedgies followed by Insider Monkey, comprising an estimated $10.4 million in stock, and Minhua Zhang’s Weld Capital Management was right behind this move, as the fund dropped about $1.3 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 5 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Regenxbio Inc (NASDAQ:RGNX). These stocks are SciPlay Corporation (NASDAQ:SCPL), Enerplus Corporation (NYSE:ERF), 360 Finance, Inc. (NASDAQ:QFIN), and Badger Meter, Inc. (NYSE:BMI). This group of stocks’ market valuations match RGNX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCPL | 16 | 95579 | 16 |

| ERF | 12 | 130197 | -9 |

| QFIN | 9 | 10013 | 8 |

| BMI | 12 | 114305 | -2 |

| Average | 12.25 | 87524 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $219 million in RGNX’s case. SciPlay Corporation (NASDAQ:SCPL) is the most popular stock in this table. On the other hand 360 Finance, Inc. (NASDAQ:QFIN) is the least popular one with only 9 bullish hedge fund positions. Regenxbio Inc (NASDAQ:RGNX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately RGNX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on RGNX were disappointed as the stock returned -30.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.