The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Regeneron Pharmaceuticals Inc (NASDAQ:REGN).

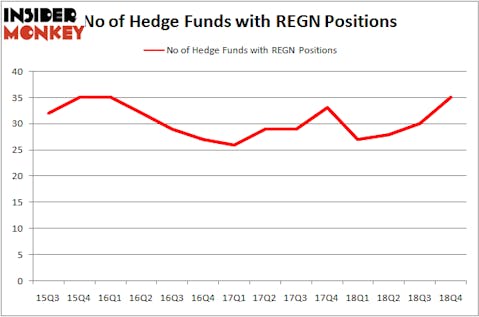

Is Regeneron Pharmaceuticals Inc (NASDAQ:REGN) a worthy investment right now? The smart money is betting on the stock. The number of long hedge fund positions advanced by 5 recently. Our calculations also showed that REGN isn’t among the 30 most popular stocks among hedge funds. REGN was in 35 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 30 hedge funds in our database with REGN positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s analyze the recent hedge fund action regarding Regeneron Pharmaceuticals Inc (NASDAQ:REGN).

Hedge fund activity in Regeneron Pharmaceuticals Inc (NASDAQ:REGN)

Heading into the first quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the second quarter of 2018. By comparison, 27 hedge funds held shares or bullish call options in REGN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Healthcor Management LP held the most valuable stake in Regeneron Pharmaceuticals Inc (NASDAQ:REGN), which was worth $215.6 million at the end of the third quarter. On the second spot was Two Sigma Advisors which amassed $213.3 million worth of shares. Moreover, Citadel Investment Group, D E Shaw, and Renaissance Technologies were also bullish on Regeneron Pharmaceuticals Inc (NASDAQ:REGN), allocating a large percentage of their portfolios to this stock.

Consequently, some big names were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in Regeneron Pharmaceuticals Inc (NASDAQ:REGN). Point72 Asset Management had $63 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $28.8 million position during the quarter. The other funds with new positions in the stock are Gilchrist Berg’s Water Street Capital, Matthew Hulsizer’s PEAK6 Capital Management, and Ian Cumming and Joseph Steinberg’s Leucadia National.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Regeneron Pharmaceuticals Inc (NASDAQ:REGN) but similarly valued. These stocks are Relx PLC (NYSE:RELX), Marsh & McLennan Companies, Inc. (NYSE:MMC), Phillips 66 (NYSE:PSX), and Kimberly Clark Corporation (NYSE:KMB). All of these stocks’ market caps are similar to REGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RELX | 5 | 73822 | 0 |

| MMC | 29 | 659019 | 0 |

| PSX | 47 | 2113027 | 4 |

| KMB | 37 | 778746 | 11 |

| Average | 29.5 | 906154 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $906 million. That figure was $1143 million in REGN’s case. Phillips 66 (NYSE:PSX) is the most popular stock in this table. On the other hand Relx PLC (NYSE:RELX) is the least popular one with only 5 bullish hedge fund positions. Regeneron Pharmaceuticals Inc (NASDAQ:REGN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately REGN wasn’t in this group. Hedge funds that bet on REGN were disappointed as the stock returned 11% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.