While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding QuinStreet Inc (NASDAQ:QNST).

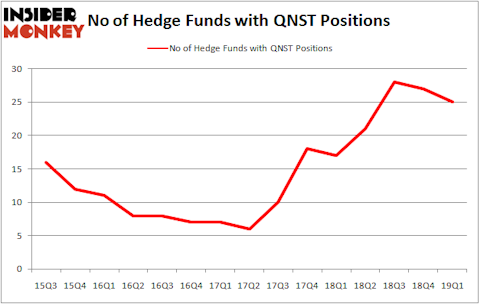

QuinStreet Inc (NASDAQ:QNST) was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. QNST investors should be aware of a decrease in hedge fund sentiment in recent months. There were 27 hedge funds in our database with QNST holdings at the end of the previous quarter. Our calculations also showed that QNST isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action encompassing QuinStreet Inc (NASDAQ:QNST).

How are hedge funds trading QuinStreet Inc (NASDAQ:QNST)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in QNST a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Park West Asset Management held the most valuable stake in QuinStreet Inc (NASDAQ:QNST), which was worth $56.3 million at the end of the first quarter. On the second spot was Private Capital Management which amassed $46 million worth of shares. Moreover, PAR Capital Management, Portolan Capital Management, and Royce & Associates were also bullish on QuinStreet Inc (NASDAQ:QNST), allocating a large percentage of their portfolios to this stock.

Judging by the fact that QuinStreet Inc (NASDAQ:QNST) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedge funds who were dropping their entire stakes in the third quarter. Intriguingly, Peter Schliemann’s Rutabaga Capital Management said goodbye to the biggest stake of all the hedgies watched by Insider Monkey, valued at an estimated $4 million in stock, and Brian C. Freckmann’s Lyon Street Capital was right behind this move, as the fund dropped about $1.8 million worth. These transactions are interesting, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to QuinStreet Inc (NASDAQ:QNST). We will take a look at Urstadt Biddle Properties Inc. (NYSE:UBP), Penn Virginia Corporation (NASDAQ:PVAC), CorePoint Lodging Inc. (NYSE:CPLG), and eXp World Holdings, Inc. (NASDAQ:EXPI). All of these stocks’ market caps are similar to QNST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBP | 2 | 12578 | 0 |

| PVAC | 17 | 167038 | 1 |

| CPLG | 13 | 39801 | -3 |

| EXPI | 4 | 3233 | -3 |

| Average | 9 | 55663 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $56 million. That figure was $200 million in QNST’s case. Penn Virginia Corporation (NASDAQ:PVAC) is the most popular stock in this table. On the other hand Urstadt Biddle Properties Inc. (NYSE:UBP) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks QuinStreet Inc (NASDAQ:QNST) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on QNST as the stock returned 15.2% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.