Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Qualys Inc (NASDAQ:QLYS), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

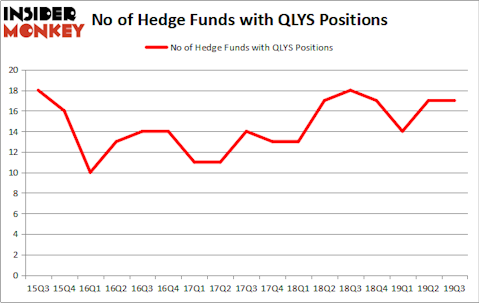

Qualys Inc (NASDAQ:QLYS) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of the third quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Old National Bancorp (NASDAQ:ONB), Envestnet Inc (NYSE:ENV), and Telephone & Data Systems, Inc. (NYSE:TDS) to gather more data points. Our calculations also showed that QLYS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the key hedge fund action surrounding Qualys Inc (NASDAQ:QLYS).

What does smart money think about Qualys Inc (NASDAQ:QLYS)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in QLYS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, founded by Jim Simons, holds the most valuable position in Qualys Inc (NASDAQ:QLYS). Renaissance Technologies has a $34.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Israel Englander of Millennium Management, with a $16.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish include Ken Griffin’s Citadel Investment Group, Noam Gottesman’s GLG Partners and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Navellier & Associates allocated the biggest weight to Qualys Inc (NASDAQ:QLYS), around 0.37% of its 13F portfolio. Gotham Asset Management is also relatively very bullish on the stock, designating 0.13 percent of its 13F equity portfolio to QLYS.

Since Qualys Inc (NASDAQ:QLYS) has witnessed bearish sentiment from hedge fund managers, we can see that there exists a select few hedgies that elected to cut their entire stakes last quarter. Interestingly, Panayotis Takis Sparaggis’s Alkeon Capital Management said goodbye to the biggest position of the 750 funds monitored by Insider Monkey, comprising an estimated $35.1 million in call options. Matthew Hulsizer’s fund, PEAK6 Capital Management, also said goodbye to its call options, about $1.6 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Qualys Inc (NASDAQ:QLYS). We will take a look at Old National Bancorp (NASDAQ:ONB), Envestnet Inc (NYSE:ENV), Telephone & Data Systems, Inc. (NYSE:TDS), and Navient Corp (NASDAQ:NAVI). This group of stocks’ market caps are closest to QLYS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ONB | 10 | 23347 | 0 |

| ENV | 13 | 64119 | 0 |

| TDS | 26 | 301772 | 1 |

| NAVI | 30 | 448459 | 4 |

| Average | 19.75 | 209424 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $209 million. That figure was $113 million in QLYS’s case. Navient Corp (NASDAQ:NAVI) is the most popular stock in this table. On the other hand Old National Bancorp (NASDAQ:ONB) is the least popular one with only 10 bullish hedge fund positions. Qualys Inc (NASDAQ:QLYS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on QLYS as the stock returned 15.8% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.