“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Pure Acquisition Corp. (NASDAQ:PACQ) in order to identify whether reputable and successful top money managers continue to believe in its potential.

Hedge fund interest in Pure Acquisition Corp. (NASDAQ:PACQ) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare PACQ to other stocks including Zymeworks Inc. (NYSE:ZYME), Blackrock Muni Intermediate Drtn Fnd Inc (NYSE:MUI), and Crawford & Company (NYSE:CRD) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to analyze the latest hedge fund action encompassing Pure Acquisition Corp. (NASDAQ:PACQ).

What have hedge funds been doing with Pure Acquisition Corp. (NASDAQ:PACQ)?

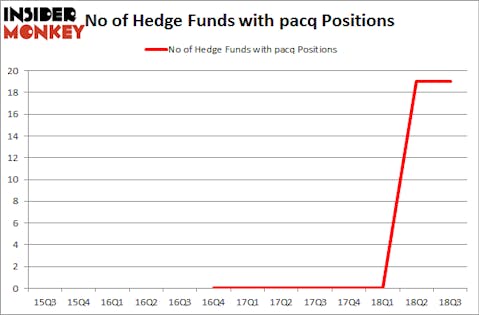

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PACQ over the last 13 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Pure Acquisition Corp. (NASDAQ:PACQ) was held by Glazer Capital, which reported holding $14.1 million worth of stock at the end of September. It was followed by Bulldog Investors with a $12.7 million position. Other investors bullish on the company included Millennium Management, Hudson Bay Capital Management, and Arosa Capital Management.

Seeing as Pure Acquisition Corp. (NASDAQ:PACQ) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there exists a select few fund managers that elected to cut their positions entirely in the third quarter. Intriguingly, Ari Zweiman’s 683 Capital Partners cut the biggest investment of all the hedgies followed by Insider Monkey, worth about $2.1 million in stock, and Andrew Weiss’s Weiss Asset Management was right behind this move, as the fund sold off about $1.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Pure Acquisition Corp. (NASDAQ:PACQ) but similarly valued. We will take a look at Zymeworks Inc. (NYSE:ZYME), BlackRock Muni Intermediate Duration Fund, Inc. (NYSE:MUI), Crawford & Company (NYSE:CRD), and Financial Institutions, Inc. (NASDAQ:FISI). This group of stocks’ market valuations match PACQ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZYME | 13 | 95045 | 1 |

| MUI | 3 | 2322 | -2 |

| CRD | 7 | 17926 | 3 |

| FISI | 12 | 44875 | -1 |

| Average | 8.75 | 40042 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $109 million in PACQ’s case. Zymeworks Inc. (NYSE:ZYME) is the most popular stock in this table. On the other hand BlackRock Muni Intermediate Duration Fund, Inc. (NYSE:MUI) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Pure Acquisition Corp. (NASDAQ:PACQ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.