“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards PulteGroup, Inc. (NYSE:PHM) and see how it was affected.

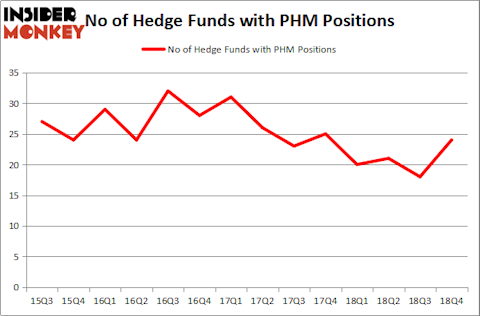

PulteGroup, Inc. (NYSE:PHM) investors should be aware of an increase in hedge fund interest in recent months. Our calculations also showed that PHM isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are assumed to be unimportant, old investment tools of the past. While there are more than 8000 funds trading at the moment, Our researchers hone in on the crème de la crème of this club, about 750 funds. Most estimates calculate that this group of people direct the majority of the smart money’s total capital, and by observing their first-class stock picks, Insider Monkey has figured out various investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the latest hedge fund action encompassing PulteGroup, Inc. (NYSE:PHM).

How are hedge funds trading PulteGroup, Inc. (NYSE:PHM)?

Heading into the first quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the second quarter of 2018. On the other hand, there were a total of 20 hedge funds with a bullish position in PHM a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Greenhaven Associates held the most valuable stake in PulteGroup, Inc. (NYSE:PHM), which was worth $179.3 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $108.5 million worth of shares. Moreover, Millennium Management, Two Sigma Advisors, and Renaissance Technologies were also bullish on PulteGroup, Inc. (NYSE:PHM), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers have jumped into PulteGroup, Inc. (NYSE:PHM) headfirst. Renaissance Technologies, managed by Jim Simons, created the most outsized position in PulteGroup, Inc. (NYSE:PHM). Renaissance Technologies had $32.5 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $17.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Joe DiMenna’s ZWEIG DIMENNA PARTNERS, D. E. Shaw’s D E Shaw, and Hoon Kim’s Quantinno Capital.

Let’s also examine hedge fund activity in other stocks similar to PulteGroup, Inc. (NYSE:PHM). We will take a look at Sarepta Therapeutics Inc (NASDAQ:SRPT), Service Corporation International (NYSE:SCI), Cemex SAB de CV (NYSE:CX), and Hyatt Hotels Corporation (NYSE:H). This group of stocks’ market values are closest to PHM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRPT | 41 | 940036 | -2 |

| SCI | 17 | 523621 | 2 |

| CX | 10 | 100016 | -3 |

| H | 25 | 638419 | -6 |

| Average | 23.25 | 550523 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $551 million. That figure was $567 million in PHM’s case. Sarepta Therapeutics Inc (NASDAQ:SRPT) is the most popular stock in this table. On the other hand Cemex SAB de CV (NYSE:CX) is the least popular one with only 10 bullish hedge fund positions. PulteGroup, Inc. (NYSE:PHM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately PHM wasn’t in this group. Hedge funds that bet on PHM were disappointed as the stock returned 11.4% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.