At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

PS Business Parks Inc (NYSE:PSB) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of September. At the end of this article we will also compare PSB to other stocks including National Health Investors Inc (NYSE:NHI), Fresh Del Monte Produce Inc (NYSE:FDP), and Worthington Industries, Inc. (NYSE:WOR) to get a better sense of its popularity.

Follow Ps Business Parks Inc. (NYSE:PSB)

Follow Ps Business Parks Inc. (NYSE:PSB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Mikko Lemola/Shutterstock.com

Keeping this in mind, we’re going to take a look at the recent action surrounding PS Business Parks Inc (NYSE:PSB).

What have hedge funds been doing with PS Business Parks Inc (NYSE:PSB)?

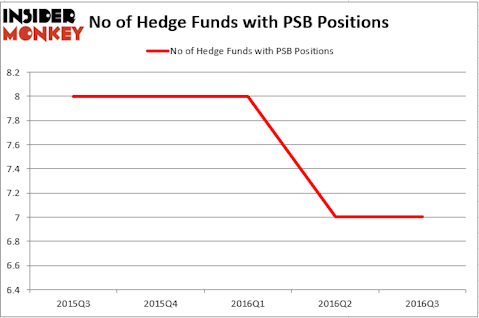

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in PSB over the last 5 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Millennium Management, one of the biggest hedge funds in the world, has the number one position in PS Business Parks Inc (NYSE:PSB), worth close to $38.6 million, amounting to 0.1% of its total 13F portfolio. Coming in second is Jim Simons of Renaissance Technologies, with a $26.7 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish comprise Greg Poole’s Echo Street Capital Management, Cliff Asness’s AQR Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.