Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

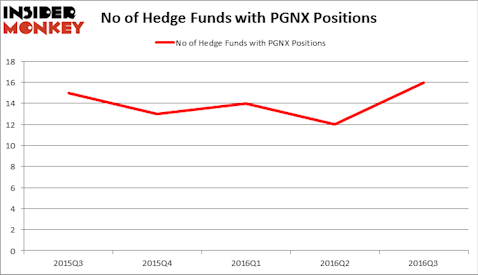

One stock that experienced an increase in hedge fund interest last quarter is Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX). During the third quarter, the number of funds tracked by Insider Monkey bullish on the stock went up by four to 16. At the end of this article we will also compare PGNX to other stocks including Oriental Financial Group Inc. (NYSE:OFG), OraSure Technologies, Inc. (NASDAQ:OSUR), and QAD Inc. (NASDAQ:QADA) to get a better sense of its popularity.

Follow Progenics Pharmaceuticals Inc (NASDAQ:PGNX)

Follow Progenics Pharmaceuticals Inc (NASDAQ:PGNX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

wavebreakmedia/Shutterstock.com

Keeping this in mind, let’s view the recent action regarding Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX).

How are hedge funds trading Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX)?

As stated earlier, at the end of the third quarter, 16 funds tracked by Insider Monkey were long Progenics Pharmaceuticals, a change of 33% from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in PGNX at the beginning of this year. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Kevin Kotler’s Broadfin Capital has the most valuable position in Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX), worth close to $56.7 million, comprising 5.1% of its total 13F portfolio. On Broadfin Capital’s heels is Baker Bros. Advisors, led by Julian Baker and Felix Baker, holding a $23.1 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism contain Millennium Management, which is one of the 10 largest funds in the world, and Chuck Royce’s Royce & Associates. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds have been driving this bullishness. Park West Asset Management, led by Peter S. Park, initiated the largest position in Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX). Park West Asset Management had $3.4 million invested in the company at the end of the quarter. Anders Hallberg and Carl Bennet’s HealthInvest Partners AB also made a $1.8 million investment in the stock during the quarter. The following funds were also among the new PGNX investors: Ken Griffin’s Citadel Investment Group, Mike Vranos’s Ellington, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s go over hedge fund activity in other stocks similar to Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX). These stocks are Oriental Financial Group Inc. (NYSE:OFG), OraSure Technologies, Inc. (NASDAQ:OSUR), QAD Inc. (NASDAQ:QADA), and Myokardia Inc (NASDAQ:MYOK). This group of stocks’ market valuations are similar to PGNX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OFG | 11 | 26041 | 3 |

| OSUR | 21 | 73743 | -2 |

| QADA | 11 | 52569 | 1 |

| MYOK | 15 | 81279 | 9 |

As you can see these stocks had an average of 15 funds with bullish positions and the average amount invested in these stocks was $58 million, which is lower than the $122 million figure in PGNX’s case. OraSure Technologies, Inc. (NASDAQ:OSUR) is the most popular stock in this table. On the other hand Oriental Financial Group Inc. (NYSE:OFG) is the least popular one with only 11 bullish hedge fund positions. Progenics Pharmaceuticals, Inc. (NASDAQ:PGNX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OraSure Technologies, Inc. (NASDAQ:OSUR) might be a better candidate to consider taking a long position in.

Disclosure: none