At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Primerica, Inc. (NYSE:PRI) at the end of the second quarter and determine whether the smart money was really smart about this stock.

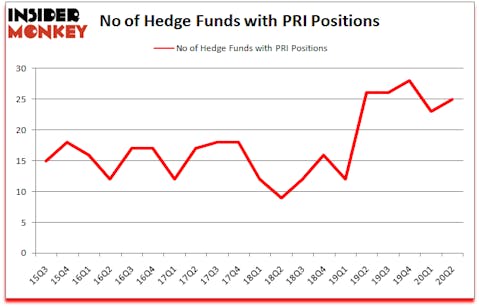

Is Primerica, Inc. (NYSE:PRI) a bargain? Hedge funds were buying. The number of bullish hedge fund positions rose by 2 lately. Primerica, Inc. (NYSE:PRI) was in 25 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 28. Our calculations also showed that PRI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 23 hedge funds in our database with PRI positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are perceived as underperforming, old financial tools of yesteryear. While there are over 8000 funds trading today, We look at the crème de la crème of this club, around 850 funds. Most estimates calculate that this group of people preside over the majority of the hedge fund industry’s total capital, and by shadowing their inimitable picks, Insider Monkey has spotted a few investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

William Von Mueffling of Cantillon Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a glance at the fresh hedge fund action surrounding Primerica, Inc. (NYSE:PRI).

What have hedge funds been doing with Primerica, Inc. (NYSE:PRI)?

Heading into the third quarter of 2020, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in PRI a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in Primerica, Inc. (NYSE:PRI) was held by Brave Warrior Capital, which reported holding $181.6 million worth of stock at the end of September. It was followed by Cantillon Capital Management with a $124.6 million position. Other investors bullish on the company included GLG Partners, Prospector Partners, and Brant Point Investment Management. In terms of the portfolio weights assigned to each position Brave Warrior Capital allocated the biggest weight to Primerica, Inc. (NYSE:PRI), around 9.03% of its 13F portfolio. Running Oak Capital is also relatively very bullish on the stock, dishing out 1.92 percent of its 13F equity portfolio to PRI.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Running Oak Capital, managed by Seth Cogswell, established the most valuable position in Primerica, Inc. (NYSE:PRI). Running Oak Capital had $4.9 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also made a $0.8 million investment in the stock during the quarter. The following funds were also among the new PRI investors: Greg Eisner’s Engineers Gate Manager and Karim Abbadi and Edward McBride’s Centiva Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Primerica, Inc. (NYSE:PRI) but similarly valued. These stocks are Targa Resources Corp (NYSE:TRGP), BlackLine, Inc. (NASDAQ:BL), Ultragenyx Pharmaceutical Inc (NASDAQ:RARE), Cullen/Frost Bankers, Inc. (NYSE:CFR), Leggett & Platt, Inc. (NYSE:LEG), Globus Medical Inc (NYSE:GMED), and Eastgroup Properties Inc (NYSE:EGP). This group of stocks’ market caps resemble PRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRGP | 31 | 289537 | 2 |

| BL | 18 | 227498 | 0 |

| RARE | 24 | 352560 | 6 |

| CFR | 13 | 21532 | -5 |

| LEG | 29 | 184075 | 4 |

| GMED | 32 | 132005 | 13 |

| EGP | 14 | 46516 | 1 |

| Average | 23 | 179103 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $385 million in PRI’s case. Globus Medical Inc (NYSE:GMED) is the most popular stock in this table. On the other hand Cullen/Frost Bankers, Inc. (NYSE:CFR) is the least popular one with only 13 bullish hedge fund positions. Primerica, Inc. (NYSE:PRI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PRI is 65.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 21.3% in 2020 through September 25th and beat the market by 17.7 percentage points. Unfortunately PRI wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on PRI were disappointed as the stock returned -3.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Primerica Inc. (NYSE:PRI)

Follow Primerica Inc. (NYSE:PRI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.