Insider Monkey finished processing more than 700 13F filings from various hedge funds and other prominent investors. These filings show these funds’ portfolio positions as of September 30. In this article we are going to take a look at smart money sentiment towards Priceline.com Inc (NASDAQ:PCLN).

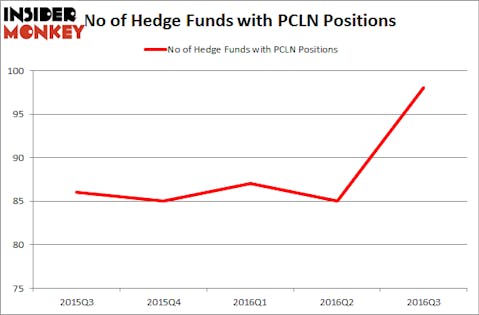

Is Priceline.com Inc (NASDAQ:PCLN) a good investment right now? The smart money is becoming more confident, as the number of funds from our database holding shares of the company went up by 13 to 98 during the third quarter. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives, which is why at the end of this article we will examine companies such as Goldman Sachs Group, Inc. (NYSE:GS), Avago Technologies Ltd (NASDAQ:AVGO), and Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU) to gather more data points.

Follow Booking Holdings Inc. (NASDAQ:BKNG)

Follow Booking Holdings Inc. (NASDAQ:BKNG)

Receive real-time insider trading and news alerts

In the financial world there are dozens of metrics market participants have at their disposal to size up stocks. A pair of the best metrics are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best investment managers can trounce the market by a healthy margin (see the details here).

Now, we’re going to take a glance at the latest action surrounding Priceline.com Inc (NASDAQ:PCLN).

Rawpixel.com/Shutterstock.com

How are hedge funds trading Priceline.com Inc (NASDAQ:PCLN)?

As stated earlier, at the end of the third quarter, 98 funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the end of June. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the largest position in Priceline.com Inc (NASDAQ:PCLN), which is worth $1.35 billion, comprising 19.5% of its 13F portfolio. Coming in second is Lone Pine Capital, managed by Stephen Mandel, which holds a $845.6 million stake; the fund has 3.8% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Ken Griffin’s Citadel Investment Group, Lee Ainslie’s Maverick Capital and John Armitage’s Egerton Capital Limited.

As aggregate interest increased, key hedge funds were breaking ground themselves. Citadel Investment Group assembled the most valuable call position in Priceline.com Inc (NASDAQ:PCLN) and had $724 million invested in the company at the end of the quarter. Eric W. Mandelblatt’s Soroban Capital Partners also made a $223.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Barry Rosenstein’s JANA Partners, Chase Coleman’s Tiger Global Management LLC, and Leon Shaulov’s Maplelane Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Priceline.com Inc (NASDAQ:PCLN) but similarly valued. We will take a look at Goldman Sachs Group, Inc. (NYSE:GS), Avago Technologies Ltd (NASDAQ:AVGO), Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU), and Enterprise Products Partners L.P. (NYSE:EPD). This group of stocks’ market caps resemble PCLN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GS | 63 | 4772004 | -5 |

| AVGO | 76 | 8267068 | 2 |

| MTU | 16 | 87370 | 4 |

| EPD | 30 | 522615 | 2 |

As you can see these stocks had an average of 46 hedge funds with bullish positions and the average amount invested in these stocks was $3.41 billion. That figure was $8.19 billion in PCLN’s case. Avago Technologies Ltd (NASDAQ:AVGO) is the most popular stock in this table, while Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU) is the least popular one with only 16 funds from our database reporting holdings as of the end of September. Compared to these stocks Priceline.com Inc (NASDAQ:PCLN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.