We recently published a list of Jim Cramer’s Latest Stock Portfolio: Top 10 Recommendations. Since Powell Industries, Inc. (NASDAQ:POWL) ranks 8th on the list, it deserves a deeper look.

Jim Cramer in a latest program talked about the concept of “suitability” of stocks in investing, which emphasizes the importance of picking individual stocks based on your personal context, circumstances and life goals instead of short-term market movements. Cramer recalled his days at the Harvard Law School and how he used to run to the library to read research reports on companies to dig out information on quality stocks on a week-to-week basis. When Cramer joined Goldman Sachs, an “executive” at the firm introduced him to the concept of suitability, advising him never to recommend stocks to people without knowing what they want out of investing. According to Cramer, that “best semiconductor stock” might not be good for all individuals and therefore it’s necessary to know the “tolerance” and risk appetite of investors.

Answering a question during the program, Cramer said technical analysis, including paying attention to RSI values, is “incredibly” important to him and he does not like to buy stocks if “their chart is bad.”

For this program we watched several latest programs of Jim Cramer and picked 10 stocks he talked about recently. These include stocks he’s bullish on as well as the ones he recommends selling. We have analyzed each stock in detail to see its fundamentals and know what the Wall Street believes about it. We have also mentioned hedge fund sentiment with each company. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

Powell Industries, Inc. (NASDAQ:POWL)

Number of Hedge Fund Investors: 24

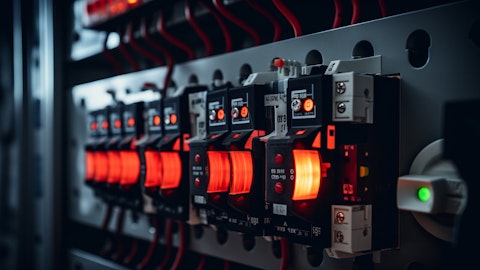

When asked about Powell Industries, Inc. (NASDAQ:POWL) in a latest program, Jim Cramer said “all of these companies are on fire.” He said it’s “another” company that does “processes and packaging” for electricity and distribution.

Powell Industries, Inc. (NASDAQ:POWL) has indeed been on fire this year, up 66% through July 4.

Analysts believe Powell Industries, Inc. (NASDAQ:POWL) growth can continue on the back of strong catalysts. Its operations are mostly focused on electrical automation and control. Over the 18 months Powell Industries, Inc. (NASDAQ:POWL) has posted strong revenue growth and beaten estimates every quarter in the period. Analysts expect Powell Industries, Inc.’s (NASDAQ:POWL) revenue growth to come in at a CAGR of 25% through this year. As of May POWL had 20% of its market cap as cash and no debt. Powell’s price/free cash flow ratio stands at 7.61, below the industry average of 13.53. Its forward P/E of 15.74 is below the industry median of 18. While Powell Industries, Inc. (NASDAQ:POWL) recently warned of capacity issues, the stock can continue to grow on the back of strong growth catalysts, which now include AI. Powell Industries, Inc. (NASDAQ:POWL) in Q2 earning call talked about the potential of data centers for its business:

We have primarily served the outside connection of the data center to the grid and see the potential for further penetration within the 4 walls of the data center where Powell Industries, Inc. (NASDAQ:POWL) can provide increased value. In addition, sales to data center customers have generally been smaller in scale and focused on individual products. However, as data centers grow in both physical size and computing power, the electrical energy demanded by these facilities will only grow in scale. As a result, the power solutions required by data centers will also grow in sophistication and require companies like Powell Industries, Inc. (NASDAQ:POWL) to build customized and fully integrated solutions within a single power control room to ensure the reliability and uptime performance of the servers to store and secure the data.

Diamond Hill Capital Long-Short Fund stated the following regarding Powell Industries, Inc. (NASDAQ:POWL) in its first quarter 2024 investor letter:

“As valuations have risen, it has become increasingly challenging to find high-quality companies trading at interesting valuations. Accordingly, we didn’t initiate any new long positions during the quarter. However, we did introduce three new short positions, including Powell Industries, Inc. (NASDAQ:POWL), Royal Caribbean Group and YETI Holdings.

Powell Industries designs, manufactures and services complex electrical systems for several industries. While recent fundamentals have been solid, we believe the valuation has become stretched for what has historically been a highly cyclical business and accordingly initiated a new short position in Q1.”

Overall, Powell Industries, Inc. (NASDAQ:POWL) ranks 8th on Insider Monkey’s list titled Jim Cramer’s Latest Stock Portfolio: Top 10 Recommendations. While we acknowledge the potential of Powell Industries, Inc. (NASDAQ:POWL), our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than Powell Industries, Inc. (NASDAQ:POWL) but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These Stocks.

Disclosure: None. This article is originally published at Insider Monkey.