The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 28 holdings, data that is available nowhere else. Should you consider Popular Inc (NASDAQ:BPOP) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

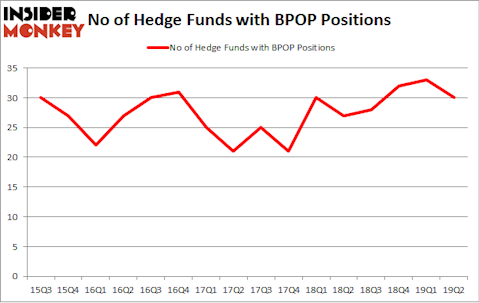

Is Popular Inc (NASDAQ:BPOP) a buy right now? Money managers are getting less optimistic. The number of long hedge fund positions shrunk by 3 recently. Our calculations also showed that BPOP isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the key hedge fund action surrounding Popular Inc (NASDAQ:BPOP).

How are hedge funds trading Popular Inc (NASDAQ:BPOP)?

At Q2’s end, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BPOP over the last 16 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Bernard Horn’s Polaris Capital Management has the most valuable position in Popular Inc (NASDAQ:BPOP), worth close to $226.9 million, corresponding to 9.6% of its total 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $155.1 million position; 0.2% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism consist of Noam Gottesman’s GLG Partners, Anand Parekh’s Alyeska Investment Group and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Popular Inc (NASDAQ:BPOP) has witnessed falling interest from the aggregate hedge fund industry, we can see that there was a specific group of hedge funds who were dropping their entire stakes last quarter. Intriguingly, Louis Bacon’s Moore Global Investments dropped the largest stake of the “upper crust” of funds tracked by Insider Monkey, worth about $16.7 million in stock. Andrew Feldstein and Stephen Siderow’s fund, Blue Mountain Capital, also sold off its stock, about $6.1 million worth. These moves are important to note, as total hedge fund interest dropped by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Popular Inc (NASDAQ:BPOP) but similarly valued. These stocks are Syneos Health, Inc. (NASDAQ:SYNH), Hudson Pacific Properties Inc (NYSE:HPP), W.R. Grace & Co. (NYSE:GRA), and United Microelectronics Corporation (NYSE:UMC). This group of stocks’ market values are closest to BPOP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYNH | 20 | 256102 | -6 |

| HPP | 17 | 320087 | 5 |

| GRA | 36 | 1898870 | 0 |

| UMC | 12 | 100702 | -3 |

| Average | 21.25 | 643940 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $644 million. That figure was $741 million in BPOP’s case. W.R. Grace & Co. (NYSE:GRA) is the most popular stock in this table. On the other hand United Microelectronics Corporation (NYSE:UMC) is the least popular one with only 12 bullish hedge fund positions. Popular Inc (NASDAQ:BPOP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BPOP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BPOP were disappointed as the stock returned 0.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (view the video below) among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.