Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

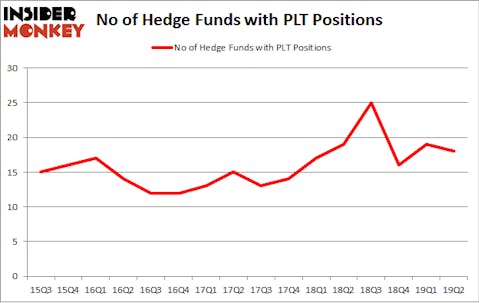

Plantronics, Inc. (NYSE:PLT) was in 18 hedge funds’ portfolios at the end of June. PLT has seen a decrease in hedge fund interest lately. There were 19 hedge funds in our database with PLT holdings at the end of the previous quarter. Our calculations also showed that PLT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are perceived as slow, outdated financial vehicles of yesteryear. While there are more than 8000 funds with their doors open today, Our researchers hone in on the elite of this group, about 750 funds. These investment experts orchestrate the lion’s share of the smart money’s total capital, and by watching their first-class equity investments, Insider Monkey has revealed many investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the recent hedge fund action regarding Plantronics, Inc. (NYSE:PLT).

How are hedge funds trading Plantronics, Inc. (NYSE:PLT)?

Heading into the third quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards PLT over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Plantronics, Inc. (NYSE:PLT) was held by Lakewood Capital Management, which reported holding $31.7 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $22.4 million position. Other investors bullish on the company included Greenhouse Funds, Greenhouse Funds, and 12th Street Asset Management.

Due to the fact that Plantronics, Inc. (NYSE:PLT) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds who sold off their positions entirely by the end of the second quarter. It’s worth mentioning that Ken Grossman and Glen Schneider’s SG Capital Management dumped the largest position of the 750 funds monitored by Insider Monkey, comprising close to $15.7 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund said goodbye to about $6.9 million worth. These transactions are important to note, as total hedge fund interest dropped by 1 funds by the end of the second quarter.

Let’s check out hedge fund activity in other stocks similar to Plantronics, Inc. (NYSE:PLT). These stocks are Athenex, Inc. (NASDAQ:ATNX), MicroStrategy Incorporated (NASDAQ:MSTR), TPG RE Finance Trust, Inc. (NYSE:TRTX), and Bed Bath & Beyond Inc. (NASDAQ:BBBY). This group of stocks’ market caps are closest to PLT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATNX | 10 | 395521 | 2 |

| MSTR | 17 | 174646 | -3 |

| TRTX | 9 | 48533 | -2 |

| BBBY | 20 | 288496 | -9 |

| Average | 14 | 226799 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $227 million. That figure was $90 million in PLT’s case. Bed Bath & Beyond Inc. (NASDAQ:BBBY) is the most popular stock in this table. On the other hand TPG RE Finance Trust, Inc. (NYSE:TRTX) is the least popular one with only 9 bullish hedge fund positions. Plantronics, Inc. (NYSE:PLT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PLT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PLT were disappointed as the stock returned 1.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.