The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR).

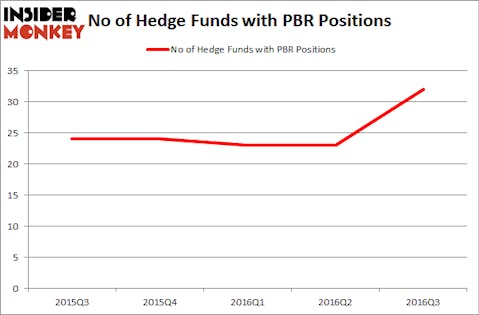

Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR) has seen an increase in support from the world’s most elite money managers in recent months. PBR was in 32 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with PBR holdings at the end of the previous quarter. At the end of this article we will also compare PBR to other stocks including Suncor Energy Inc. (USA) (NYSE:SU), Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA), and EOG Resources Inc (NYSE:EOG) to get a better sense of its popularity.

Follow Petroleo Brasileiro Sa Petrobras (NYSE:PBR)

Follow Petroleo Brasileiro Sa Petrobras (NYSE:PBR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Dmitry Kalinovsky/Shutterstock.com

Keeping this in mind, we’re going to go over the latest action encompassing Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR).

How are hedge funds trading Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR)?

Heading into the fourth quarter of 2016, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a 39% jump from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR), worth close to $262.4 million. Sitting at the No. 2 spot is Rob Citrone of Discovery Capital Management, with a $146.1 million position; 3.1% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish include Ken Fisher’s Fisher Asset Management and John Horseman’s Horseman Capital Management.

Now, some big names were leading the bulls’ herd. Discovery Capital Management assembled the most valuable position in Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR) The other funds with new positions in the stock are Alan Howard’s Brevan Howard, George Soros’ Soros Fund Management, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry asPetroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR) but similarly valued. We will take a look at Suncor Energy Inc. (USA) (NYSE:SU), Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA), EOG Resources Inc (NYSE:EOG), and Canadian National Railway (USA) (NYSE:CNI). This group of stocks’ market valuations are closest to PBR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SU | 22 | 809820 | -3 |

| TEVA | 54 | 4254824 | -1 |

| EOG | 51 | 1275879 | 15 |

| CNI | 17 | 1447565 | -4 |

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $1.95 billion. That figure was $1.03 billion in PBR’s case. Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) is the most popular stock in this table. On the other hand Canadian National Railway (USA) (NYSE:CNI) is the least popular one with only 17 bullish hedge fund positions. Petroleo Brasileiro SA Petrobras (ADR) (NYSE:PBR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TEVA or EOG might be better candidates to consider long positions in.

Disclosure: None