Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR)? The smart money sentiment can provide an answer to this question.

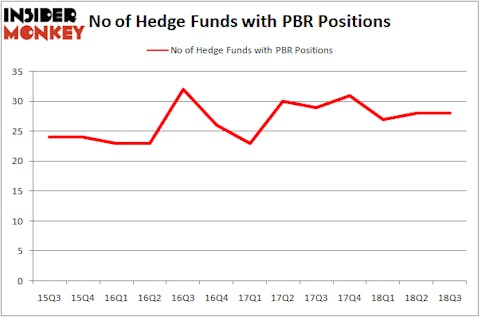

Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 28 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Sony Corporation (NYSE:SNE), Vale SA (NYSE:VALE), and Starbucks Corporation (NASDAQ:SBUX) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the fresh hedge fund action encompassing Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR).

How are hedge funds trading Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR)?

At Q3’s end, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the second quarter of 2018. On the other hand, there were a total of 31 hedge funds with a bullish position in PBR at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) was held by Fisher Asset Management, which reported holding $489.9 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $343.8 million position. Other investors bullish on the company included Arrowstreet Capital, HBK Investments, and Arrowstreet Capital.

Due to the fact that Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) has witnessed bearish sentiment from the smart money, it’s easy to see that there is a sect of hedge funds that elected to cut their positions entirely in the third quarter. At the top of the heap, Rob Citrone’s Discovery Capital Management sold off the biggest investment of all the hedgies watched by Insider Monkey, worth about $41.7 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dumped about $10.2 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR). These stocks are Sony Corporation (NYSE:SNE), Vale SA (NYSE:VALE), Starbucks Corporation (NASDAQ:SBUX), and Danaher Corporation (NYSE:DHR). This group of stocks’ market caps resemble PBR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNE | 27 | 709311 | 3 |

| VALE | 35 | 2585315 | 3 |

| SBUX | 33 | 934942 | -9 |

| DHR | 51 | 2629626 | 6 |

| Average | 36.5 | 1714799 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.72 billion. That figure was $2.06 billion in PBR’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand Sony Corporation (NYSE:SNE) is the least popular one with only 27 bullish hedge fund positions. Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DHR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.