How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Pensare Acquisition Corp. (NASDAQ:WRLS).

Hedge fund interest in Pensare Acquisition Corp. (NASDAQ:WRLS) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Village Super Market, Inc. (NASDAQ:VLGEA), Osiris Therapeutics, Inc. (NASDAQ:OSIR), and Nuvectra Corporation (NASDAQ:NVTR) to gather more data points.

If you’d ask most investors, hedge funds are assumed to be underperforming, old financial vehicles of years past. While there are over 8,000 funds with their doors open today, We look at the top tier of this group, around 700 funds. These hedge fund managers command bulk of the smart money’s total asset base, and by following their top stock picks, Insider Monkey has figured out a few investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the recent hedge fund action encompassing Pensare Acquisition Corp. (NASDAQ:WRLS).

How are hedge funds trading Pensare Acquisition Corp. (NASDAQ:WRLS)?

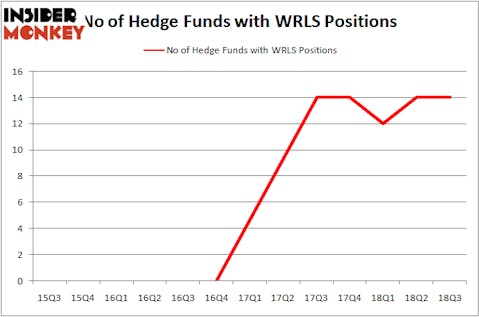

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the previous quarter. The graph below displays the number of hedge funds with bullish position in WRLS over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pacific Grove Capital held the most valuable stake in Pensare Acquisition Corp. (NASDAQ:WRLS), which was worth $10.5 million at the end of the third quarter. On the second spot was Glazer Capital which amassed $7.5 million worth of shares. Moreover, Jet Capital Investors, Pacific Grove Capital, and Scoggin were also bullish on Pensare Acquisition Corp. (NASDAQ:WRLS), allocating a large percentage of their portfolios to this stock.

Seeing as Pensare Acquisition Corp. (NASDAQ:WRLS) has experienced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their full holdings by the end of the third quarter. At the top of the heap, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. sold off the biggest position of the 700 funds followed by Insider Monkey, comprising about $3.7 million in stock. George McCabe’s fund, Portolan Capital Management, also said goodbye to its stock, about $1.8 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Pensare Acquisition Corp. (NASDAQ:WRLS). These stocks are Village Super Market, Inc. (NASDAQ:VLGEA), Osiris Therapeutics, Inc. (NASDAQ:OSIR), Nuvectra Corporation (NASDAQ:NVTR), and SandRidge Energy Inc. (NYSE:SD). All of these stocks’ market caps match WRLS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VLGEA | 5 | 52076 | -2 |

| OSIR | 4 | 1533 | 4 |

| NVTR | 20 | 69194 | 4 |

| SD | 19 | 113215 | -1 |

| Average | 12 | 59005 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $45 million in WRLS’s case. Nuvectra Corporation (NASDAQ:NVTR) is the most popular stock in this table. On the other hand Osiris Therapeutics, Inc. (NASDAQ:OSIR) is the least popular one with only 4 bullish hedge fund positions. Pensare Acquisition Corp. (NASDAQ:WRLS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NVTR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.