Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of PDF Solutions, Inc. (NASDAQ:PDFS).

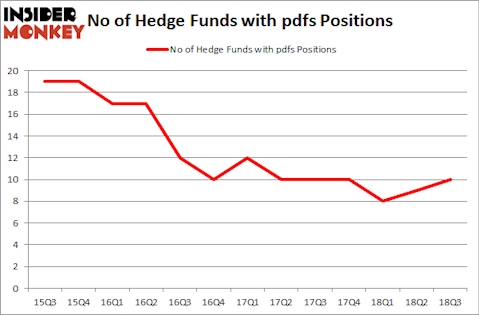

Is PDF Solutions, Inc. (NASDAQ:PDFS) ready to rally soon? Money managers are betting on the stock. The number of long hedge fund positions rose by 1 recently. Our calculations also showed that pdfs isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are several tools shareholders employ to appraise their stock investments. Two of the most under-the-radar tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can trounce the S&P 500 by a superb margin (see the details here).

We’re going to take a look at the key hedge fund action regarding PDF Solutions, Inc. (NASDAQ:PDFS).

What have hedge funds been doing with PDF Solutions, Inc. (NASDAQ:PDFS)?

Heading into the fourth quarter of 2018, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in PDFS heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, VIEX Capital Advisors, managed by Eric Singer, holds the largest position in PDF Solutions, Inc. (NASDAQ:PDFS). VIEX Capital Advisors has a $6.2 million position in the stock, comprising 5.3% of its 13F portfolio. Coming in second is Royce & Associates, led by Chuck Royce, holding a $3.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass David Brown’s Hawk Ridge Management, Paul Hondros’s AlphaOne Capital Partners and Bradley LouisáRadoff’s Fondren Management.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Fondren Management, managed by Bradley LouisáRadoff, assembled the most outsized position in PDF Solutions, Inc. (NASDAQ:PDFS). Fondren Management had $1.5 million invested in the company at the end of the quarter. Eric Singer’s VIEX Capital Advisors also initiated a $0.8 million position during the quarter. The following funds were also among the new PDFS investors: Matthew Hulsizer’s PEAK6 Capital Management and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as PDF Solutions, Inc. (NASDAQ:PDFS) but similarly valued. These stocks are Southern First Bancshares, Inc. (NASDAQ:SFST), Celcuity Inc. (NASDAQ:CELC), Energy Fuels Inc (NYSE:UUUU), and The New Germany Fund, Inc. (NYSE:GF). All of these stocks’ market caps are similar to PDFS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFST | 7 | 37838 | 0 |

| CELC | 1 | 336 | -1 |

| UUUU | 6 | 4386 | 2 |

| GF | 2 | 411 | 1 |

| Average | 4 | 10743 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $11 million. That figure was $18 million in PDFS’s case. Southern First Bancshares, Inc. (NASDAQ:SFST) is the most popular stock in this table. On the other hand Celcuity Inc. (NASDAQ:CELC) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks PDF Solutions, Inc. (NASDAQ:PDFS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.