We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Patterson Companies, Inc. (NASDAQ:PDCO).

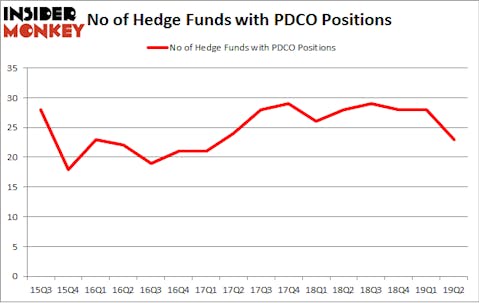

Is Patterson Companies, Inc. (NASDAQ:PDCO) an excellent investment today? The smart money is in a pessimistic mood. The number of bullish hedge fund bets retreated by 5 in recent months. Our calculations also showed that PDCO isn’t among the 30 most popular stocks among hedge funds (view the video below). PDCO was in 23 hedge funds’ portfolios at the end of the second quarter of 2019. There were 28 hedge funds in our database with PDCO positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are viewed as underperforming, old financial tools of the past. While there are over 8000 funds with their doors open at the moment, Our researchers look at the masters of this group, approximately 750 funds. These hedge fund managers have their hands on most of all hedge funds’ total asset base, and by tailing their top picks, Insider Monkey has revealed many investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action surrounding Patterson Companies, Inc. (NASDAQ:PDCO).

Hedge fund activity in Patterson Companies, Inc. (NASDAQ:PDCO)

Heading into the third quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of -18% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in PDCO a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, GAMCO Investors held the most valuable stake in Patterson Companies, Inc. (NASDAQ:PDCO), which was worth $42.5 million at the end of the second quarter. On the second spot was Select Equity Group which amassed $29.6 million worth of shares. Moreover, Two Sigma Advisors, D E Shaw, and Cove Street Capital were also bullish on Patterson Companies, Inc. (NASDAQ:PDCO), allocating a large percentage of their portfolios to this stock.

Due to the fact that Patterson Companies, Inc. (NASDAQ:PDCO) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few funds that slashed their entire stakes heading into Q3. It’s worth mentioning that Matthew Tewksbury’s Stevens Capital Management sold off the biggest investment of all the hedgies tracked by Insider Monkey, totaling close to $2.5 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund sold off about $1.1 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 5 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Patterson Companies, Inc. (NASDAQ:PDCO). These stocks are Verra Mobility Corporation (NASDAQ:VRRM), Sanmina Corporation (NASDAQ:SANM), Otter Tail Corporation (NASDAQ:OTTR), and Akcea Therapeutics, Inc. (NASDAQ:AKCA). This group of stocks’ market caps are closest to PDCO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRRM | 21 | 173954 | 7 |

| SANM | 18 | 193604 | 0 |

| OTTR | 12 | 77316 | 2 |

| AKCA | 8 | 23583 | 1 |

| Average | 14.75 | 117114 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $117 million. That figure was $195 million in PDCO’s case. Verra Mobility Corporation (NASDAQ:VRRM) is the most popular stock in this table. On the other hand Akcea Therapeutics, Inc. (NASDAQ:AKCA) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Patterson Companies, Inc. (NASDAQ:PDCO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PDCO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PDCO were disappointed as the stock returned -21.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.