It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Park-Ohio Holdings Corp. (NASDAQ:PKOH).

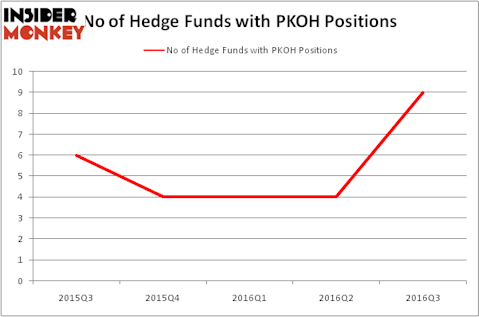

Is Park-Ohio Holdings Corp. (NASDAQ:PKOH) the right investment to pursue these days? Hedge funds are unambiguously in a bullish mood. The number of long hedge fund bets increased by 5 lately. PKOH was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. There were 4 hedge funds in our database with PKOH holdings at the end of the June quarter. At the end of this article we will also compare PKOH to other stocks including Tristate Capital Holdings Inc (NASDAQ:TSC), Powell Industries, Inc. (NASDAQ:POWL), and Iconix Brand Group Inc (NASDAQ:ICON) to get a better sense of its popularity.

Follow Park Ohio Holdings Corp (NASDAQ:PKOH)

Follow Park Ohio Holdings Corp (NASDAQ:PKOH)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

How are hedge funds trading Park-Ohio Holdings Corp. (NASDAQ:PKOH)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 125% surge from the second quarter of 2016. That also represents a 125% increase in 2016, after sentiment remained flat in the first-half of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Mario Gabelli’s GAMCO Investors has the biggest position in Park-Ohio Holdings Corp. (NASDAQ:PKOH), worth close to $32.9 million. Sitting at the No. 2 spot is Renaissance Technologies, one of the largest hedge funds in the world, which holds a $3.1 million position. Some other peers that hold long positions encompass Cliff Asness’ AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and David E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-micro-cap stocks.

Now, specific money managers have been driving this bullishness. Arrowstreet Capital established the most valuable position in Park-Ohio Holdings Corp. (NASDAQ:PKOH). Arrowstreet Capital had $1 million invested in the company at the end of the quarter. D E Shaw also initiated a $0.4 million position during the quarter. The following funds were also among the new PKOH investors: Neil Chriss’ Hutchin Hill Capital, Joel Greenblatt’s Gotham Asset Management, and Israel Englander’s Millennium Management.

Let’s go over hedge fund activity in other stocks similar to Park-Ohio Holdings Corp. (NASDAQ:PKOH). We will take a look at Tristate Capital Holdings Inc (NASDAQ:TSC), Powell Industries, Inc. (NASDAQ:POWL), Iconix Brand Group Inc (NASDAQ:ICON), and Ocwen Financial Corporation (NYSE:OCN). This group of stocks’ market values resemble PKOH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSC | 8 | 50252 | -2 |

| POWL | 14 | 49998 | 3 |

| ICON | 11 | 75907 | -4 |

| OCN | 17 | 62994 | 1 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $41 million in PKOH’s case. Ocwen Financial Corporation (NYSE:OCN) is the most popular stock in this table. On the other hand Tristate Capital Holdings Inc (NASDAQ:TSC) is the least popular one with only 8 bullish hedge fund positions. Park-Ohio Holdings Corp. (NASDAQ:PKOH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OCN might be a better candidate to consider taking a long position in.

Disclosure: None