Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Owens-Illinois Inc (NYSE:OI).

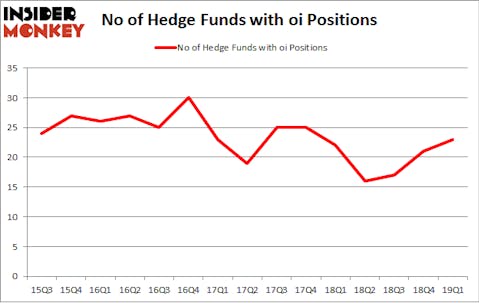

Is Owens-Illinois Inc (NYSE:OI) a bargain? Prominent investors are taking an optimistic view. The number of long hedge fund bets rose by 2 in recent months. Our calculations also showed that oi isn’t among the 30 most popular stocks among hedge funds. OI was in 23 hedge funds’ portfolios at the end of the first quarter of 2019. There were 21 hedge funds in our database with OI holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a glance at the new hedge fund action surrounding Owens-Illinois Inc (NYSE:OI).

Hedge fund activity in Owens-Illinois Inc (NYSE:OI)

Heading into the second quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the fourth quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in OI a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, First Pacific Advisors LLC held the most valuable stake in Owens-Illinois Inc (NYSE:OI), which was worth $189.3 million at the end of the first quarter. On the second spot was Atlantic Investment Management which amassed $80.6 million worth of shares. Moreover, AQR Capital Management, Millennium Management, and Spitfire Capital were also bullish on Owens-Illinois Inc (NYSE:OI), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, initiated the most valuable position in Owens-Illinois Inc (NYSE:OI). Renaissance Technologies had $7.6 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $1.3 million position during the quarter. The other funds with brand new OI positions are David Costen Haley’s HBK Investments, Dmitry Balyasny’s Balyasny Asset Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s check out hedge fund activity in other stocks similar to Owens-Illinois Inc (NYSE:OI). These stocks are frontdoor, inc. (NASDAQ:FTDR), MorphoSys AG (NASDAQ:MOR), FTI Consulting, Inc. (NYSE:FCN), and Steven Madden, Ltd. (NASDAQ:SHOO). All of these stocks’ market caps are closest to OI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTDR | 34 | 435267 | 10 |

| MOR | 7 | 41009 | -2 |

| FCN | 17 | 134797 | 1 |

| SHOO | 18 | 62053 | 0 |

| Average | 19 | 168282 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $168 million. That figure was $341 million in OI’s case. frontdoor, inc. (NASDAQ:FTDR) is the most popular stock in this table. On the other hand MorphoSys AG (NASDAQ:MOR) is the least popular one with only 7 bullish hedge fund positions. Owens-Illinois Inc (NYSE:OI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately OI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on OI were disappointed as the stock returned -13.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.