Does Outfront Media Inc (NYSE:OUT) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

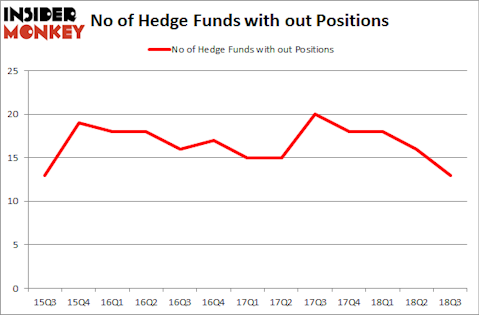

Outfront Media Inc (NYSE:OUT) investors should pay attention to a decrease in hedge fund interest in recent months. OUT was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. There were 16 hedge funds in our database with OUT positions at the end of the previous quarter. Our calculations also showed that out isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action encompassing Outfront Media Inc (NYSE:OUT).

Hedge fund activity in Outfront Media Inc (NYSE:OUT)

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in OUT heading into this year. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Steve Cohen’s Point72 Asset Management has the largest position in Outfront Media Inc (NYSE:OUT), worth close to $32.2 million, amounting to 0.1% of its total 13F portfolio. On Point72 Asset Management’s heels is Greg Poole of Echo Street Capital Management, with a $30.4 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of Dmitry Balyasny’s Balyasny Asset Management, Jim Simons’s Renaissance Technologies and Clint Carlson’s Carlson Capital.

Since Outfront Media Inc (NYSE:OUT) has faced falling interest from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies that slashed their entire stakes in the third quarter. Interestingly, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors dumped the largest investment of all the hedgies watched by Insider Monkey, totaling about $9.8 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund sold off about $1.6 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 3 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Outfront Media Inc (NYSE:OUT). We will take a look at The Michaels Companies Inc (NASDAQ:MIK), Baozun Inc (NASDAQ:BZUN), Envestnet Inc (NYSE:ENV), and Banco Macro SA (NYSE:BMA). This group of stocks’ market valuations resemble OUT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIK | 26 | 212111 | -2 |

| BZUN | 17 | 123960 | -3 |

| ENV | 13 | 70832 | 0 |

| BMA | 12 | 118446 | -4 |

| Average | 17 | 131337 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $137 million in OUT’s case. The Michaels Companies Inc (NASDAQ:MIK) is the most popular stock in this table. On the other hand Banco Macro SA (NYSE:BMA) is the least popular one with only 12 bullish hedge fund positions. Outfront Media Inc (NYSE:OUT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MIK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.