Is ONEOK, Inc. (NYSE:OKE) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

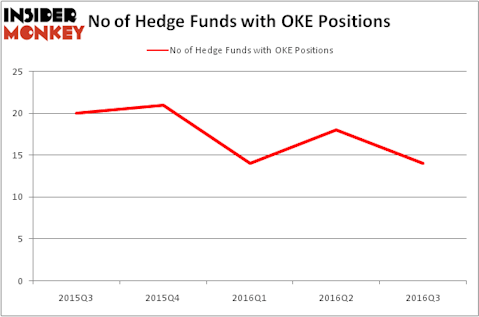

Is ONEOK, Inc. (NYSE:OKE) a marvelous stock to buy now? Hedge funds are becoming less confident. The number of long hedge fund positions experienced a decline of 4 in recent months. OKE was in 14 hedge funds’ portfolios at the end of the third quarter of 2016. There were 18 hedge funds in our database with OKE holdings at the end of the previous quarter. At the end of this article we will also compare OKE to other stocks including Medivation Inc (NASDAQ:MDVN), Lennar Corporation (NYSE:LEN), and Best Buy Co., Inc. (NYSE:BBY) to get a better sense of its popularity.

Follow Oneok Inc (Old Filings) (NYSE:OKE)

Follow Oneok Inc (Old Filings) (NYSE:OKE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

JNP/Shutterstock.com

How are hedge funds trading ONEOK, Inc. (NYSE:OKE)?

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a 22% drop from the previous quarter. There were a total of 21 hedge funds with a bullish position in OKE at the beginning of this year, which is now down by 33% through the end of September. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, GAMCO Investors, led by Mario Gabelli, holds the biggest position in ONEOK, Inc. (NYSE:OKE). GAMCO Investors has a $13.9 million position in the stock. Coming in second is Gotham Asset Management, led by Joel Greenblatt, holding an $11 million position. Some other professional money managers that hold long positions include Peter Muller’s PDT Partners, Jonathan Barrett and Paul Segal’s Luminus Management, and Ken Griffin’s Citadel Investment Group. We should note that Luminus Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Because ONEOK, Inc. (NYSE:OKE) has gone through falling interest from hedge fund managers, logic holds that there lies a certain “tier” of hedgies that slashed their entire stakes in the third quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group cashed in the largest stake of the 700 funds followed by Insider Monkey, totaling an estimated $8.4 million in call options, while retaining its long position. Curtis Macnguyen’s fund, Ivory Capital (Investment Mgmt), also sold off its stock, about $5.9 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to ONEOK, Inc. (NYSE:OKE). We will take a look at Medivation Inc (NASDAQ:MDVN), Lennar Corporation (NYSE:LEN), Best Buy Co., Inc. (NYSE:BBY), and UDR, Inc. (NYSE:UDR). All of these stocks’ market caps resemble OKE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDVN | 1 | 1850 | -64 |

| LEN | 48 | 1132322 | 8 |

| BBY | 40 | 792943 | 11 |

| UDR | 14 | 151008 | 1 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $520 million. That figure was $73 million in OKE’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand Medivation Inc (NASDAQ:MDVN) is the least popular one with only 1 bullish hedge fund positions. ONEOK, Inc. (NYSE:OKE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LEN might be a better candidate to consider taking a long position in.

Disclosure: None