Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th. What do these smart investors think about Old Dominion Freight Line, Inc. (NASDAQ:ODFL)?

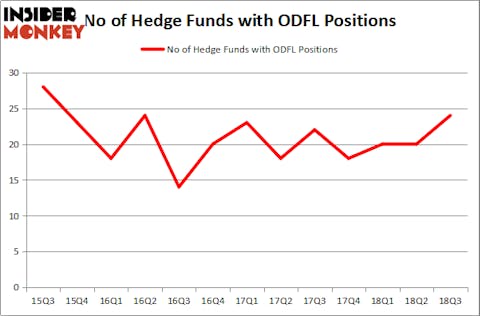

Old Dominion Freight Line, Inc. (NASDAQ:ODFL) has experienced an increase in enthusiasm from smart money lately. ODFL was in 24 hedge funds’ portfolios at the end of the third quarter of 2018, up from 20 at the end of the previous quarter. Even though smart money investors are slowly becoming more bullish on Old Dominion Freight Line, Inc. the stock is still far away from being the favorite one (and if you are interested to see which stocks hedge funds are piling on, take a look at the list of 30 most popular stocks among hedge funds in Q3 of 2018).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We tried to collect enough information about Old Dominion Freight Line, Inc. (NASDAQ:ODFL) to be able to determine whether this stock is worth buying or not. While researching we found this RiverPark – Wedgewood Fund’ third quarter 2018 report, in which, among other things, RiverPark shares its views on the company, we bring you one part of it:

“Old Dominion Freight Line has been a family run business for decades. Old Dominion was founded in 1934 in Richmond, Virginia by Earl and Lillian Congdon, running a single truck between Richmond and Norfolk. The founding year was fortuitous as the U.S. economy was in the early innings of its slow recovery from the Great Depression. During the first half of the 1940s, in combination new congressional industry regulations, and World War II armament spending, the trucking industry boomed. In the early 1950s, Earl Sr. passed, and his wife Lillian ran the Company with sons Earl, Jr. and Jack. In 1962 Earl, Jr. became President. In 1962 the Company moved to High Point, NC. The Company went public in 1991. In 1998, David Congdon (grandson of Company founders) is named President and Chief Operating Officer. In March 2018, Greg Gantt, a 24-year Company veteran was named President and COO while David Congdon becomes Vice Chairman of the Board and CEO.

In the ensuing decades, organic market expansion was complemented by acquisitions of Bottoms- Fiske Truck Line (1957), Barnes truck Line, Nilsson Motor Express and White Transport (1969), Star Transport (1972), Deaton Trucking (1979) and Carter and Sons Trucking (2001). Since 2006, trucking and transport assets were purchased from Wichita Southeast Kansas Transit, Priority Freight Line, Bullocks Express Transportation, and Bob’s Pickup.

According to the Company, more than 97% of the Company’s revenue has historically been derived from transporting LTL shipments for their customers, whose demand for their services is generally tied to industrial production and the overall health of the U.S. domestic economy. The Company is currently the third largest LTL motor carrier in the United States, as measured by 2017 revenue with 10% of the LTL market.

The growth in demand for the Company’s services can be attributed to their ability to consistently provide a superior level of customer service at a fair price, which allows customers to meet their supply chain needs. Integrated structure provides customers with consistently high-quality service from origin to destination, and operating structure and proprietary information systems enable efficient management of operating costs.

As of December 31, 2017, the Company reports that they operate 228 service center locations, of which they owned 194 and leased 34. Their network includes ten major breakbulk facilities located in Rialto, CA; Atlanta, GA; Columbus, OH; Indianapolis, IN; Greensboro, NC; Harrisburg, PA; Memphis and Morristown, TN; Dallas, TX; and Salt Lake City, UT. Service centers are strategically located throughout the country to provide the highest quality service and minimize freight rehandling costs.

According to the Company, as of December 31, 2017, the Company owned 8,316 tractors. They generally use new tractors in linehaul operations (movement of cargo between two major cities or ports, especially those more than 1,000 miles apart) for approximately three to five years and then transfer those tractors to P&D operations for the remainder of their useful lives. In many service centers, tractors perform P&D functions during the day and linehaul functions at night to maximize tractor utilization. The Company employed 19,183 individuals full-time, none of whom were represented under a collective bargaining agreement. Full-time employees work in the following roles: Drivers 10,187, Platform 3,443, Fleet technicians 557, Sales, administrative and other 4,996. Total: 19,183. The Company employed 5,311 linehaul drivers and 4,876 P&D drivers full-time. They select drivers primarily based on safe driving records and experience.”

On the next page you can read few more paragraphs from RiverParks’ report, as well as our further analysis of the company.

“Since 1988, the Company has provided the opportunity for qualified employees to become drivers through the “Old Dominion Driver Training Program.” There are currently 2,892 active drivers who have successfully completed this training, which was approximately 28.4% of the driver workforce as of December 31, 2017. Their driver training and qualification programs have been important factors in improving their safety record and retaining qualified drivers.

Annual turnover rate for driver graduates is approximately 5.9%, which is below the Company- wide turnover rate for all drivers of approximately 8.0%. Drivers who maintain safe driving records receive annual bonuses of up to $3,000 per driver.

Revenue is generated primarily from customers throughout the United States and other parts of North America with 60% industrial and 25% retail and 15% residential. In 2017, the largest customer accounted for approximately 3.7% of revenue and the largest 5, 10 and 20 customers accounted for 11.2%, 17.0%, and 23.6% of revenue, respectively. For each of the previous three years, more than 95% of revenue was derived from services performed in the United States and less than 5% of revenue was generated from services performed internationally.

The Company’s long-held strategy is to grow capacity and build terminal density to ultimately get closer to their customers. Old Dominion’s competitive advantage is their industry-leading LTL hub and spoke network capacity, which insures 99% on-time delivery on 1 and 2-day deliveries. Proof of their competitive advantage is their consistent +600 bps operating margin advantage relative to their competitors.

Annual network capex expenditures are also a Company competitive advantage to ensure industry- leading customer satisfaction. In 2018 capex should reach $555 million – $310 for tractors and trailers and $200 million in real estate and service center expansion. 2017 capex was $382 million. The Company opened 10 and 22 new service centers over the past five and ten years, respectively, for a total of 228 service centers as of December 31, 2017.

Several of Old Dominion’s larger competitors have shrunk their service terminal networks or outsourced shipping capacity to third parties during the past decade, meanwhile Old Dominion has continued to expand its network of service centers, and owned-and-operated linehaul and P&D tractors. As a result of Old Dominion’s consistent, long-term strategy to reinvest in capacity, the Company has substantially less reliance on purchased (third party contracted) transportation capacity, just as the trucking industry finds itself staring down a long road of labor shortages. Historically, Old Dominion has had a low single-digit percent of revenues serviced by third party capacity, and a few years ago moved even further away from this reliance. A limited reliance on purchased transportation allows management to focus on maximizing the profitability of Old Dominion’s existing capacity, while prudently reinvesting in incremental capacity. We think the Company’s focus of driving returns on owned-capacity is a superior long-term strategy, compared to chasing market share, especially against the backdrop of a domestic trucking industry facing chronic capacity shortages.

We expect Old Dominion revenues to continue benefitting from the long-term shift towards LTL mode of shipping. Despite continued reinvestment in capacity to meet demand, we expect industry leading operating ratios to continue, and help drive an attractive long-term, double-digit growth profile for the Company.

Earnings per share in 2017 were $5.63. 2018 and 2019 earnings expectations are $6.45 and $7.25, respectively.”

Despite RiverParks’ optimism about the stock, we are still not convinced, which is why we’ll take a gander at the key hedge fund action regarding Old Dominion Freight Line, Inc. (NASDAQ:ODFL).

What have hedge funds been doing with Old Dominion Freight Line, Inc. (NASDAQ:ODFL)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ODFL over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in Old Dominion Freight Line, Inc. (NASDAQ:ODFL) was held by AQR Capital Management, which reported holding $85.5 million worth of stock at the end of September. It was followed by Sirios Capital Management with a $41.4 million position. Other investors bullish on the company included Chilton Investment Company, Renaissance Technologies, and Millennium Management.

As one would reasonably expect, specific money managers have jumped into Old Dominion Freight Line, Inc. (NASDAQ:ODFL) headfirst. Renaissance Technologies, managed by Jim Simons, created the biggest position in Old Dominion Freight Line, Inc. (NASDAQ:ODFL). Renaissance Technologies had $18.1 million invested in the company at the end of the quarter. Ilya Boroditsky’s Precision Path Capital also initiated a $4.9 million position during the quarter. The other funds with brand new ODFL positions are Mike Vranos’s Ellington, George Hall’s Clinton Group, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Old Dominion Freight Line, Inc. (NASDAQ:ODFL) but similarly valued. These stocks are Aegon N.V. (NYSE:AEG), CarMax, Inc. (NYSE:KMX), Dover Corporation (NYSE:DOV), and Mohawk Industries, Inc. (NYSE:MHK). All of these stocks’ market caps are closest to ODFL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AEG | 7 | 45622 | 3 |

| KMX | 31 | 1755991 | 0 |

| DOV | 23 | 1251557 | -1 |

| MHK | 49 | 2513475 | 3 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1392 million. That figure was $253 million in ODFL’s case. Mohawk Industries, Inc. (NYSE:MHK) is the most popular stock in this table. On the other hand Aegon N.V. (NYSE:AEG) is the least popular one with only 7 bullish hedge fund positions. Old Dominion Freight Line, Inc. (NASDAQ:ODFL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MHK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.