“Since 1988, the Company has provided the opportunity for qualified employees to become drivers through the “Old Dominion Driver Training Program.” There are currently 2,892 active drivers who have successfully completed this training, which was approximately 28.4% of the driver workforce as of December 31, 2017. Their driver training and qualification programs have been important factors in improving their safety record and retaining qualified drivers.

Annual turnover rate for driver graduates is approximately 5.9%, which is below the Company- wide turnover rate for all drivers of approximately 8.0%. Drivers who maintain safe driving records receive annual bonuses of up to $3,000 per driver.

Revenue is generated primarily from customers throughout the United States and other parts of North America with 60% industrial and 25% retail and 15% residential. In 2017, the largest customer accounted for approximately 3.7% of revenue and the largest 5, 10 and 20 customers accounted for 11.2%, 17.0%, and 23.6% of revenue, respectively. For each of the previous three years, more than 95% of revenue was derived from services performed in the United States and less than 5% of revenue was generated from services performed internationally.

The Company’s long-held strategy is to grow capacity and build terminal density to ultimately get closer to their customers. Old Dominion’s competitive advantage is their industry-leading LTL hub and spoke network capacity, which insures 99% on-time delivery on 1 and 2-day deliveries. Proof of their competitive advantage is their consistent +600 bps operating margin advantage relative to their competitors.

Annual network capex expenditures are also a Company competitive advantage to ensure industry- leading customer satisfaction. In 2018 capex should reach $555 million – $310 for tractors and trailers and $200 million in real estate and service center expansion. 2017 capex was $382 million. The Company opened 10 and 22 new service centers over the past five and ten years, respectively, for a total of 228 service centers as of December 31, 2017.

Several of Old Dominion’s larger competitors have shrunk their service terminal networks or outsourced shipping capacity to third parties during the past decade, meanwhile Old Dominion has continued to expand its network of service centers, and owned-and-operated linehaul and P&D tractors. As a result of Old Dominion’s consistent, long-term strategy to reinvest in capacity, the Company has substantially less reliance on purchased (third party contracted) transportation capacity, just as the trucking industry finds itself staring down a long road of labor shortages. Historically, Old Dominion has had a low single-digit percent of revenues serviced by third party capacity, and a few years ago moved even further away from this reliance. A limited reliance on purchased transportation allows management to focus on maximizing the profitability of Old Dominion’s existing capacity, while prudently reinvesting in incremental capacity. We think the Company’s focus of driving returns on owned-capacity is a superior long-term strategy, compared to chasing market share, especially against the backdrop of a domestic trucking industry facing chronic capacity shortages.

We expect Old Dominion revenues to continue benefitting from the long-term shift towards LTL mode of shipping. Despite continued reinvestment in capacity to meet demand, we expect industry leading operating ratios to continue, and help drive an attractive long-term, double-digit growth profile for the Company.

Earnings per share in 2017 were $5.63. 2018 and 2019 earnings expectations are $6.45 and $7.25, respectively.”

Despite RiverParks’ optimism about the stock, we are still not convinced, which is why we’ll take a gander at the key hedge fund action regarding Old Dominion Freight Line, Inc. (NASDAQ:ODFL).

What have hedge funds been doing with Old Dominion Freight Line, Inc. (NASDAQ:ODFL)?

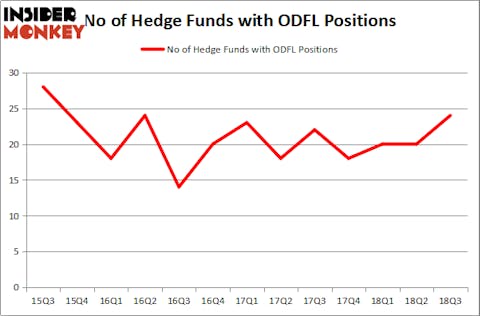

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ODFL over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in Old Dominion Freight Line, Inc. (NASDAQ:ODFL) was held by AQR Capital Management, which reported holding $85.5 million worth of stock at the end of September. It was followed by Sirios Capital Management with a $41.4 million position. Other investors bullish on the company included Chilton Investment Company, Renaissance Technologies, and Millennium Management.

As one would reasonably expect, specific money managers have jumped into Old Dominion Freight Line, Inc. (NASDAQ:ODFL) headfirst. Renaissance Technologies, managed by Jim Simons, created the biggest position in Old Dominion Freight Line, Inc. (NASDAQ:ODFL). Renaissance Technologies had $18.1 million invested in the company at the end of the quarter. Ilya Boroditsky’s Precision Path Capital also initiated a $4.9 million position during the quarter. The other funds with brand new ODFL positions are Mike Vranos’s Ellington, George Hall’s Clinton Group, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Old Dominion Freight Line, Inc. (NASDAQ:ODFL) but similarly valued. These stocks are Aegon N.V. (NYSE:AEG), CarMax, Inc. (NYSE:KMX), Dover Corporation (NYSE:DOV), and Mohawk Industries, Inc. (NYSE:MHK). All of these stocks’ market caps are closest to ODFL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AEG | 7 | 45622 | 3 |

| KMX | 31 | 1755991 | 0 |

| DOV | 23 | 1251557 | -1 |

| MHK | 49 | 2513475 | 3 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1392 million. That figure was $253 million in ODFL’s case. Mohawk Industries, Inc. (NYSE:MHK) is the most popular stock in this table. On the other hand Aegon N.V. (NYSE:AEG) is the least popular one with only 7 bullish hedge fund positions. Old Dominion Freight Line, Inc. (NASDAQ:ODFL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MHK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.