In this article we will check out the progression of hedge fund sentiment towards Nucor Corporation (NYSE:NUE) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

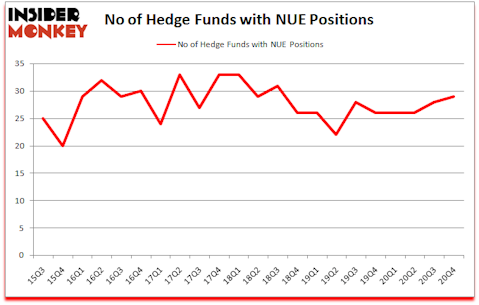

Is NUE stock a buy? Nucor Corporation (NYSE:NUE) was in 29 hedge funds’ portfolios at the end of December. The all time high for this statistic is 33. NUE shareholders have witnessed an increase in hedge fund sentiment of late. There were 28 hedge funds in our database with NUE positions at the end of the third quarter. Our calculations also showed that NUE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Blair Levinsky of Waratah Capital Advisors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a gander at the key hedge fund action regarding Nucor Corporation (NYSE:NUE).

Do Hedge Funds Think NUE Is A Good Stock To Buy Now?

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the third quarter of 2020. By comparison, 26 hedge funds held shares or bullish call options in NUE a year ago. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the largest position in Nucor Corporation (NYSE:NUE). D E Shaw has a $54.3 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $17.2 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions include Ken Fisher’s Fisher Asset Management, Michael Gelband’s ExodusPoint Capital and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Arjuna Capital allocated the biggest weight to Nucor Corporation (NYSE:NUE), around 0.85% of its 13F portfolio. Waratah Capital Advisors is also relatively very bullish on the stock, setting aside 0.36 percent of its 13F equity portfolio to NUE.

Consequently, some big names have jumped into Nucor Corporation (NYSE:NUE) headfirst. Tudor Investment Corp, managed by Paul Tudor Jones, assembled the most outsized position in Nucor Corporation (NYSE:NUE). Tudor Investment Corp had $5.4 million invested in the company at the end of the quarter. Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors also made a $5.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, Farnum Brown and Adam Seitchik’s Arjuna Capital, and Mika Toikka’s AlphaCrest Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Nucor Corporation (NYSE:NUE) but similarly valued. We will take a look at KeyCorp (NYSE:KEY), Citrix Systems, Inc. (NASDAQ:CTXS), Seagate Technology plc (NASDAQ:STX), Tiffany & Co. (NYSE:TIF), Varian Medical Systems, Inc. (NYSE:VAR), BioMarin Pharmaceutical Inc. (NASDAQ:BMRN), and SK Telecom Co., Ltd. (NYSE:SKM). This group of stocks’ market values resemble NUE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KEY | 29 | 317740 | -4 |

| CTXS | 29 | 352466 | -2 |

| STX | 30 | 2167418 | 7 |

| TIF | 48 | 2623109 | -13 |

| VAR | 49 | 2414410 | -3 |

| BMRN | 51 | 1670835 | 7 |

| SKM | 4 | 104096 | 0 |

| Average | 34.3 | 1378582 | -1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.3 hedge funds with bullish positions and the average amount invested in these stocks was $1379 million. That figure was $139 million in NUE’s case. BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 4 bullish hedge fund positions. Nucor Corporation (NYSE:NUE) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for NUE is 59. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.2% in 2021 through April 12th and still beat the market by 1.5 percentage points. A small number of hedge funds were also right about betting on NUE as the stock returned 52.2% since the end of the fourth quarter (through 4/12) and outperformed the market by an even larger margin.

Follow Nucor Corp (NYSE:NUE)

Follow Nucor Corp (NYSE:NUE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.