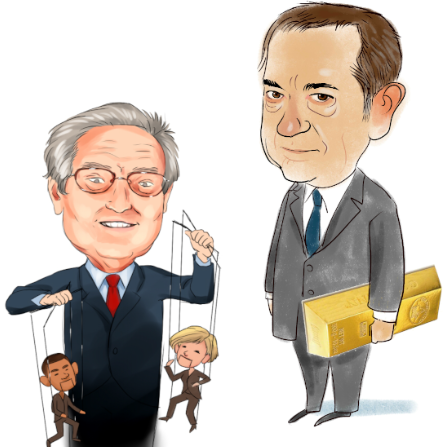

We recently covered billionaire Paulson’s most favorite metals and mining stocks. NovaGold Resources Inc (NYSE:NG) is part of the list. In this article we take a closer look at the stock. But first, let’s see what Paulson is up to these days.

Billionaire John Paulson made a strong comeback last year after suffering heavy losses from his healthcare bets in 2022. According to data from Bloomberg, Paulson’s funds returned about 32% in 2023, driven by gains from some of the best-performing mining, healthcare and financial stocks. Bloomberg also said that the 68-year-old billionaire, who is one of Donald Trump’s favorite candidates for the Treasury secretary role, was picking up momentum this year, with his funds gaining about $600 million in 2024 through mid-April.

Paulson, worth about $3.5 billion, has been in the news for several reasons lately. He filed for divorce in 2021, and is still embroiled in the legal battle with his former wife. He recently got engaged to his 35-year-old girlfriend Alina de Almeida. Paulson is also busy in a legal battle with his former business partners as the billionaire’s car dealerships in Puerto Rico were damaged in multiple fire eruptions.

But there’s more to Paulson that these scandals and controversies. He made a name (and wealth) for himself with his prescient stock-picking skills and wisdom. Paulson started warning about the subprime mortgage crisis back in 2006 and betting against the housing market. In the first nine months of 2007, Paulson’s Credit Opportunities funds jumped about 340%. Reports suggest that Paulson pocketed about $20 billion for himself and investors following the subprime mortgage bonds collapse.

For this article we scanned Paulson & Co.’s Q1’2024 portfolio and picked top 9 metals & mining stocks Paulson is owning significant stakes in and ranked them by using the dollar amount invested by billionaire John Paulson. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

A detailed report by journalist Anthony Effinger recalls one of Paulson’s letters to investors written just before the subprime mortgage crisis:

“We expect credit performance of subprime mortgages to continue to deteriorate,” Paulson told investors in his first-quarter report, sent out in April. By the U.S. summer, mortgage securities were in full retreat. Paulson’s Credit Opportunities funds soared in value, rising 75.7 percent in July and 26.5 percent in August.”

NovaGold Resources Inc (NYSE:NG)

Billionaire John Paulson Q1’2024 Stake Value: $81,714,183

Billionaire John Paulson has been holding stakes in NovaGold Resources Inc (NYSE:NG) for about 14 years now. As of the end of the first quarter of 2024, Paulson & Co. reported owning an $82 million stake in NovaGold Resources Inc (NYSE:NG).

For 2024, the mining company, which is working on the Donlin gold mine in Alaska, expects expenses of $31.2 million, including $14.3 million to fund the Donlin Gold project, and $16.9 million for corporate general and administrative costs.

Insider Monkey’s database of 919 hedge funds shows that 20 hedge funds reported owning stakes in NovaGold Resources Inc (NYSE:NG) as of the end of March. The biggest stakeholder of NovaGold Resources Inc (NYSE:NG) (after Paulson) is First Eagle Investment Management of Jean-Marie Eveillard which a $55 million stake.

NovaGold Resources Inc (NYSE:NG) ranks 2nd in the list of 9 Best Mining Stocks to Buy According to Billionaire Paulson.

If you are looking for an AI stock that is as promising as Microsoft but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and Opportunities in Uranium Stocks.

Disclosure: None. This article is originally published at Insider Monkey.