Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of NIKE, Inc. (NYSE:NKE) and see how the stock is affected by the recent hedge fund activity.

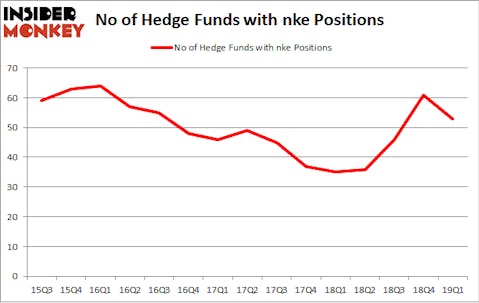

Is NIKE, Inc. (NYSE:NKE) a buy, sell, or hold? Money managers are taking a bearish view. The number of bullish hedge fund positions were cut by 8 recently. Our calculations also showed that nke isn’t among the 30 most popular stocks among hedge funds. NKE was in 53 hedge funds’ portfolios at the end of March. There were 61 hedge funds in our database with NKE positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are many tools shareholders use to appraise stocks. A duo of the less known tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top investment managers can outperform the broader indices by a solid margin (see the details here).

We’re going to check out the recent hedge fund action encompassing NIKE, Inc. (NYSE:NKE).

How are hedge funds trading NIKE, Inc. (NYSE:NKE)?

Heading into the second quarter of 2019, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. By comparison, 35 hedge funds held shares or bullish call options in NKE a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the number one position in NIKE, Inc. (NYSE:NKE). AQR Capital Management has a $511.9 million position in the stock, comprising 0.5% of its 13F portfolio. The second most bullish fund manager is Citadel Investment Group, managed by Ken Griffin, which holds a $133.3 million call position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers with similar optimism include Lee Ainslie’s Maverick Capital, William B. Gray’s Orbis Investment Management and James Crichton’s Hitchwood Capital Management.

Because NIKE, Inc. (NYSE:NKE) has witnessed falling interest from the smart money, it’s safe to say that there were a few hedge funds that elected to cut their full holdings by the end of the third quarter. At the top of the heap, Gabriel Plotkin’s Melvin Capital Management sold off the largest stake of all the hedgies followed by Insider Monkey, valued at close to $59.3 million in stock. Gregg Moskowitz’s fund, Interval Partners, also dumped its stock, about $37.1 million worth. These transactions are important to note, as total hedge fund interest dropped by 8 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to NIKE, Inc. (NYSE:NKE). We will take a look at Adobe Inc (NASDAQ:ADBE), Eli Lilly and Company (NYSE:LLY), International Business Machines Corp. (NYSE:IBM), and Novo Nordisk A/S (NYSE:NVO). This group of stocks’ market valuations match NKE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADBE | 86 | 8965741 | 2 |

| LLY | 44 | 2163009 | -3 |

| IBM | 46 | 2215447 | -2 |

| NVO | 25 | 2388157 | 7 |

| Average | 50.25 | 3933089 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.25 hedge funds with bullish positions and the average amount invested in these stocks was $3933 million. That figure was $1768 million in NKE’s case. Adobe Inc (NASDAQ:ADBE) is the most popular stock in this table. On the other hand Novo Nordisk A/S (NYSE:NVO) is the least popular one with only 25 bullish hedge fund positions. NIKE, Inc. (NYSE:NKE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NKE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NKE were disappointed as the stock returned -5.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.