We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Melvin Capital’s recent GameStop losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Nicolet Bankshares Inc. (NASDAQ:NCBS).

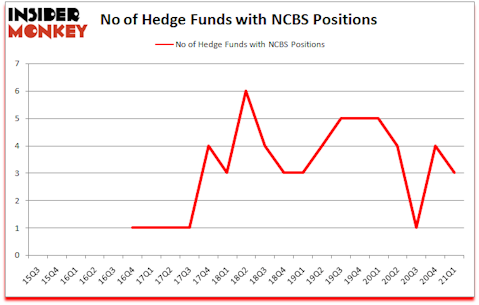

Is Nicolet Bankshares Inc. (NASDAQ:NCBS) stock a buy? The best stock pickers were turning less bullish. The number of bullish hedge fund bets dropped by 1 lately. Nicolet Bankshares Inc. (NASDAQ:NCBS) was in 3 hedge funds’ portfolios at the end of March. The all time high for this statistic is 6. Our calculations also showed that NCBS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

If you’d ask most investors, hedge funds are perceived as underperforming, outdated investment tools of years past. While there are greater than 8000 funds in operation today, Our experts choose to focus on the top tier of this group, about 850 funds. It is estimated that this group of investors watch over bulk of the hedge fund industry’s total capital, and by following their unrivaled equity investments, Insider Monkey has formulated many investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Cliff Asness of AQR Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund wants to buy this $28 biotech stock for $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a look at the recent hedge fund action surrounding Nicolet Bankshares Inc. (NASDAQ:NCBS).

Do Hedge Funds Think NCBS Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from the fourth quarter of 2020. Below, you can check out the change in hedge fund sentiment towards NCBS over the last 23 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Citadel Investment Group, managed by Ken Griffin, holds the biggest position in Nicolet Bankshares Inc. (NASDAQ:NCBS). Citadel Investment Group has a $1.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is D E Shaw, managed by D. E. Shaw, which holds a $0.6 million position; less than 0.1%% of its 13F portfolio is allocated to the company. In terms of the portfolio weights assigned to each position D E Shaw allocated the biggest weight to Nicolet Bankshares Inc. (NASDAQ:NCBS), around 0.0006% of its 13F portfolio. AQR Capital Management is also relatively very bullish on the stock, dishing out 0.0004 percent of its 13F equity portfolio to NCBS.

Because Nicolet Bankshares Inc. (NASDAQ:NCBS) has experienced falling interest from the aggregate hedge fund industry, we can see that there exists a select few money managers that decided to sell off their positions entirely heading into Q2. Interestingly, David Harding’s Winton Capital Management said goodbye to the biggest position of the 750 funds tracked by Insider Monkey, worth about $0.7 million in stock. Israel Englander’s fund, Millennium Management, also said goodbye to its stock, about $0.3 million worth. These transactions are interesting, as total hedge fund interest fell by 1 funds heading into Q2.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Nicolet Bankshares Inc. (NASDAQ:NCBS) but similarly valued. These stocks are The Lovesac Company (NASDAQ:LOVE), Affimed NV (NASDAQ:AFMD), Brigham Minerals, Inc. (NYSE:MNRL), Anterix Inc. (NASDAQ:ATEX), Chimerix Inc (NASDAQ:CMRX), Caleres Inc (NYSE:CAL), and Trean Insurance Group, Inc. (NASDAQ:TIG). This group of stocks’ market values resemble NCBS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOVE | 18 | 109630 | 4 |

| AFMD | 23 | 262344 | 6 |

| MNRL | 13 | 54346 | -4 |

| ATEX | 16 | 368505 | 1 |

| CMRX | 16 | 200273 | 3 |

| CAL | 18 | 63148 | 3 |

| TIG | 11 | 27832 | -3 |

| Average | 16.4 | 155154 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.4 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $2 million in NCBS’s case. Affimed NV (NASDAQ:AFMD) is the most popular stock in this table. On the other hand Trean Insurance Group, Inc. (NASDAQ:TIG) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Nicolet Bankshares Inc. (NASDAQ:NCBS) is even less popular than TIG. Our overall hedge fund sentiment score for NCBS is 19. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards NCBS. Our calculations showed that the top 10 most popular hedge fund stocks returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th but managed to beat the market again by 3.3 percentage points. Unfortunately NCBS wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was very bearish); NCBS investors were disappointed as the stock returned -9.8% since the end of the first quarter (through 6/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Nicolet Bankshares Inc (NYSE:NIC)

Follow Nicolet Bankshares Inc (NYSE:NIC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.