“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Hedge fund interest in Nextera Energy Partners LP (NYSE:NEP) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare NEP to other stocks including Rexnord Corp (NYSE:RXN), The Geo Group, Inc. (NYSE:GEO), and Pampa Energia S.A. (NYSE:PAM) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the recent hedge fund action surrounding Nextera Energy Partners LP (NYSE:NEP).

How are hedge funds trading Nextera Energy Partners LP (NYSE:NEP)?

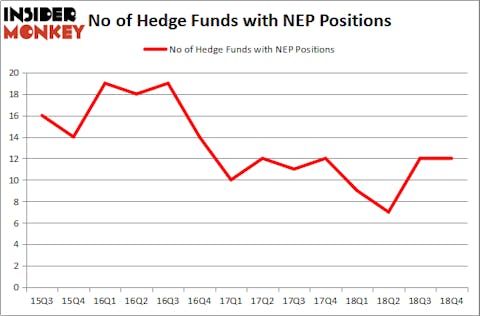

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in NEP a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Blackstart Capital was the largest shareholder of Nextera Energy Partners LP (NYSE:NEP), with a stake worth $15.2 million reported as of the end of September. Trailing Blackstart Capital was Wexford Capital, which amassed a stake valued at $7.4 million. Millennium Management, Arrowstreet Capital, and Perella Weinberg Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Nextera Energy Partners LP (NYSE:NEP) has experienced bearish sentiment from hedge fund managers, it’s easy to see that there was a specific group of fund managers who were dropping their full holdings heading into Q3. It’s worth mentioning that Bernard Lambilliotte’s Ecofin Ltd dumped the biggest position of all the hedgies watched by Insider Monkey, valued at about $9.5 million in stock. Robert Polak’s fund, Anchor Bolt Capital, also cut its stock, about $6.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Nextera Energy Partners LP (NYSE:NEP) but similarly valued. We will take a look at Rexnord Corp (NYSE:RXN), The Geo Group, Inc. (NYSE:GEO), Pampa Energia S.A. (NYSE:PAM), and Range Resources Corp. (NYSE:RRC). This group of stocks’ market values are similar to NEP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RXN | 19 | 133137 | 4 |

| GEO | 18 | 95266 | 1 |

| PAM | 15 | 295211 | 0 |

| RRC | 31 | 724194 | 2 |

| Average | 20.75 | 311952 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $312 million. That figure was $35 million in NEP’s case. Range Resources Corp. (NYSE:RRC) is the most popular stock in this table. On the other hand Pampa Energia S.A. (NYSE:PAM) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Nextera Energy Partners LP (NYSE:NEP) is even less popular than PAM. Hedge funds dodged a bullet by taking a bearish stance towards NEP. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NEP wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); NEP investors were disappointed as the stock returned 10.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.