Netflix, Inc. (NASDAQ:NFLX) shares have been on a remarkable bull run, up over 300% since 8/1/12, and the shares have added almost half of that since the start of the year. Investor sentiment continues to be bullish, and the P/E is a stratospheric 518.7.

Yet there are doubters. Rocco Pendola wrote a pair of scathing articles about Netflix, Inc. (NASDAQ:NFLX): “Netflix: The Biggest Empty Promise Since Enron?” and “Netflix News So Absurd I Couldn’t Make it Up”. In the articles, Pendola vents his mystification at the run-up, but stops short of recommending a sell.

Do these advantages make Netflix, Inc. (NASDAQ:NFLX) a good investment? Not necessarily. One question investors should ponder is what the return will be on the investment Netflix is making in new content. Lacking detailed insight into the cost structure of Netflix, especially the production costs of the new shows, Return on Invested Capital (ROIC) may offer the best insight.

Generally, ROIC should be higher than the cost of capital. If it is, then the company is increasing its value by the difference between the ROIC and its cost of capital. In the table below I give the ROIC for Netflix and other companies that are competitors or future competitors (courtesy the Wall Street Journal):

| Netflix | Amazon (NASDAQ:AMZN) | Apple (NASDAQ:AAPL) | Google (NASDAQ:GOOG) | |

| ROIC (%) | 1.03 | -0.38 | 42.84 | 15.88 |

| P/E for 2013 Q1 | 788.8 | -2908 | 10.08 | 27.03 |

I’ve included the other companies for comparison because they already distribute video content through online stores and therefore have the necessary infrastructure (massive server farms) and software capabilities to provide a subscription streaming service like Netflix. Amazon.com, Inc. (NASDAQ:AMZN) even offers a Netflix-like subscription service through Amazon Prime as well as rental and purchase content. As I discuss below, Apple Inc. (NASDAQ:AAPL) and Google Inc (NASDAQ:GOOG) may join Amazon.com, Inc. (NASDAQ:AMZN) in this “hybrid” approach.

Netflix isn’t the worst in ROIC, but its 1% ROIC is well below its current cost of capital. In February 2013 Netflix issued $500 million in Senior Notes at 5.375% interest.

Future ROIC performance

Even though Netflix doesn’t perform particularly well in ROIC at the moment, it could be argued that Netflix is growing so fast that eventually ROIC will improve. This is true, but there is a caveat: if operating margin stays constant, then ROIC doesn’t improve enough to matter. Operating margin, currently a meager 3%, is critical for Netflix, Inc. (NASDAQ:NFLX).

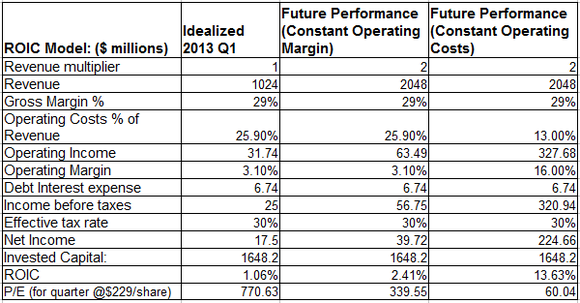

To illustrate how critical operating margin will be to future ROIC performance, I put together a simplified spreadsheet model to calculate ROIC based on three scenarios:

1) Idealized 2013 Q1: a point of departure that represents ROIC performance without some one-time only charges. Together with the quarterly interest on the new 5.375% Senior Notes, these pretty much wiped out the operating profit of $32 million. ROIC is calculated as Net Income (after taxes)/Invested Capital.

2) Future performance, constant margin: assumes a doubling of revenue, but operating margin is still 3%. ROIC increases to 2.41%.

3) Future performance, constant operating cost: once again, revenues double, but operating costs are held essentially constant. ROIC increases to 13.63%.

In fact, the prospects for the constant operating cost scenario are dim, since Netflix operating costs have historically grown at a pace equal to or greater than revenue growth. But even in this scenario, the company’s value doesn’t really catches up to its price, and its P/E of 60 is still quite a bit higher that the other companies I listed.