The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Net 1 UEPS Technologies Inc (NASDAQ:UEPS) based on those filings.

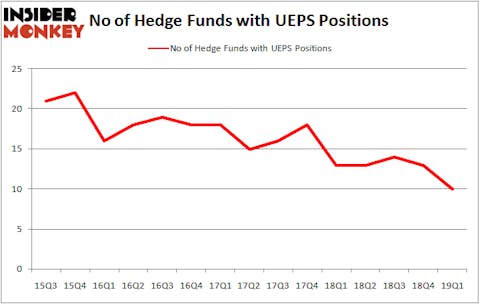

Is Net 1 UEPS Technologies Inc (NASDAQ:UEPS) the right investment to pursue these days? Money managers are taking a pessimistic view. The number of long hedge fund positions retreated by 3 lately. Our calculations also showed that UEPS isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are perceived as worthless, outdated financial tools of years past. While there are more than 8000 funds in operation today, We choose to focus on the top tier of this club, around 750 funds. These investment experts handle most of the smart money’s total capital, and by paying attention to their first-class picks, Insider Monkey has brought to light many investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s analyze the new hedge fund action regarding Net 1 UEPS Technologies Inc (NASDAQ:UEPS).

Hedge fund activity in Net 1 UEPS Technologies Inc (NASDAQ:UEPS)

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in UEPS a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, International Value Advisers, managed by Charles de Vaulx, holds the number one position in Net 1 UEPS Technologies Inc (NASDAQ:UEPS). International Value Advisers has a $29.1 million position in the stock, comprising 1.1% of its 13F portfolio. The second largest stake is held by Prescott Group Capital Management, led by Phil Frohlich, holding a $16.3 million position; the fund has 3.3% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism consist of David Rosen’s Rubric Capital Management, D. E. Shaw’s D E Shaw and Jim Simons’s Renaissance Technologies.

Because Net 1 UEPS Technologies Inc (NASDAQ:UEPS) has faced a decline in interest from hedge fund managers, it’s easy to see that there was a specific group of money managers who sold off their positions entirely last quarter. At the top of the heap, William B. Gray’s Orbis Investment Management dumped the biggest investment of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $3.8 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund cut about $0.5 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Net 1 UEPS Technologies Inc (NASDAQ:UEPS). We will take a look at PICO Holdings Inc (NASDAQ:PICO), Alico, Inc. (NASDAQ:ALCO), Ion Geophysical Corp (NYSE:IO), and Coastal Financial Corporation (NASDAQ:CCB). This group of stocks’ market caps match UEPS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PICO | 7 | 24519 | -1 |

| ALCO | 6 | 24100 | 0 |

| IO | 10 | 27737 | 3 |

| CCB | 2 | 19164 | 0 |

| Average | 6.25 | 23880 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $68 million in UEPS’s case. Ion Geophysical Corp (NYSE:IO) is the most popular stock in this table. On the other hand Coastal Financial Corporation (NASDAQ:CCB) is the least popular one with only 2 bullish hedge fund positions. Net 1 UEPS Technologies Inc (NASDAQ:UEPS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately UEPS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UEPS were disappointed as the stock returned -4.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.