The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Navistar International Corporation (NYSE:NAV) from the perspective of those elite funds.

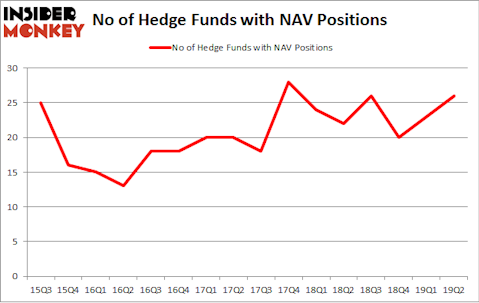

Navistar International Corporation (NYSE:NAV) has experienced an increase in support from the world’s most elite money managers of late. NAV was in 26 hedge funds’ portfolios at the end of the second quarter of 2019. There were 23 hedge funds in our database with NAV holdings at the end of the previous quarter. Our calculations also showed that NAV isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a large number of indicators stock traders have at their disposal to analyze their stock investments. A duo of the most useful indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best money managers can beat their index-focused peers by a significant margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the fresh hedge fund action surrounding Navistar International Corporation (NYSE:NAV).

How have hedgies been trading Navistar International Corporation (NYSE:NAV)?

At Q2’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NAV over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Icahn Capital LP was the largest shareholder of Navistar International Corporation (NYSE:NAV), with a stake worth $576.3 million reported as of the end of March. Trailing Icahn Capital LP was MHR Fund Management, which amassed a stake valued at $559 million. GAMCO Investors, Renaissance Technologies, and Adage Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds have jumped into Navistar International Corporation (NYSE:NAV) headfirst. Adage Capital Management, managed by Phill Gross and Robert Atchinson, established the biggest position in Navistar International Corporation (NYSE:NAV). Adage Capital Management had $23 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also initiated a $3.3 million position during the quarter. The other funds with brand new NAV positions are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, Steve Cohen’s Point72 Asset Management, and Robert Bishop’s Impala Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Navistar International Corporation (NYSE:NAV) but similarly valued. These stocks are First Hawaiian, Inc. (NASDAQ:FHB), Companhia Paranaense de Energia – COPEL (NYSE:ELP), KAR Auction Services Inc (NYSE:KAR), and Hancock Whitney Corporation (NASDAQ:HWC). This group of stocks’ market values are closest to NAV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FHB | 21 | 271430 | -2 |

| ELP | 9 | 66595 | -1 |

| KAR | 32 | 631830 | -10 |

| HWC | 16 | 103609 | 1 |

| Average | 19.5 | 268366 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $268 million. That figure was $1426 million in NAV’s case. KAR Auction Services Inc (NYSE:KAR) is the most popular stock in this table. On the other hand Companhia Paranaense de Energia – COPEL (NYSE:ELP) is the least popular one with only 9 bullish hedge fund positions. Navistar International Corporation (NYSE:NAV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NAV wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NAV were disappointed as the stock returned -18.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.