Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Natus Medical Inc (NASDAQ:NTUS) changed recently.

Is NTUS a good stock to buy? Natus Medical Inc (NASDAQ:NTUS) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of the third quarter of 2021. Our calculations also showed that NTUS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as HomeStreet Inc (NASDAQ:HMST), Personalis, Inc. (NASDAQ:PSNL), and Partner Communications Company Ltd (NASDAQ:PTNR) to gather more data points.

Ken Griffin of Citadel Investment Group

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s take a peek at the latest hedge fund action surrounding Natus Medical Inc (NASDAQ:NTUS).

Do Hedge Funds Think NTUS Is A Good Stock To Buy Now?

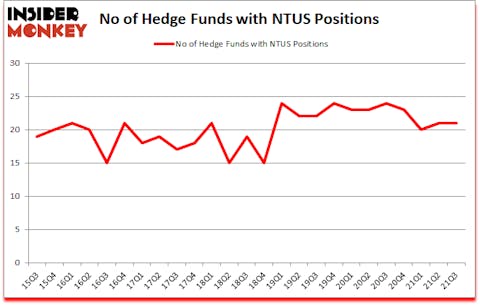

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2021. Below, you can check out the change in hedge fund sentiment towards NTUS over the last 25 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Natus Medical Inc (NASDAQ:NTUS) was held by Impax Asset Management, which reported holding $16.5 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $12.3 million position. Other investors bullish on the company included Arrowstreet Capital, Fisher Asset Management, and Royce & Associates. In terms of the portfolio weights assigned to each position Rutabaga Capital Management allocated the biggest weight to Natus Medical Inc (NASDAQ:NTUS), around 1.22% of its 13F portfolio. Factorial Partners is also relatively very bullish on the stock, dishing out 0.66 percent of its 13F equity portfolio to NTUS.

Judging by the fact that Natus Medical Inc (NASDAQ:NTUS) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of funds that elected to cut their full holdings heading into Q4. It’s worth mentioning that Matthew Stadelman’s Diamond Hill Capital dropped the largest investment of the 750 funds watched by Insider Monkey, comprising close to $9.1 million in call options, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $1.6 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Natus Medical Inc (NASDAQ:NTUS). These stocks are HomeStreet Inc (NASDAQ:HMST), Personalis, Inc. (NASDAQ:PSNL), Partner Communications Company Ltd (NASDAQ:PTNR), Tenaya Therapeutics Inc. (NASDAQ:TNYA), Caleres Inc (NYSE:CAL), Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA), and Hanger, Inc. (NYSE:HNGR). This group of stocks’ market caps match NTUS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMST | 15 | 45325 | -1 |

| PSNL | 14 | 172357 | -1 |

| PTNR | 1 | 12152 | 0 |

| TNYA | 11 | 208799 | 11 |

| CAL | 17 | 76316 | -1 |

| LOMA | 11 | 56414 | 2 |

| HNGR | 9 | 28604 | -4 |

| Average | 11.1 | 85710 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.1 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $74 million in NTUS’s case. Caleres Inc (NYSE:CAL) is the most popular stock in this table. On the other hand Partner Communications Company Ltd (NASDAQ:PTNR) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Natus Medical Inc (NASDAQ:NTUS) is more popular among hedge funds. Our overall hedge fund sentiment score for NTUS is 81.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Unfortunately NTUS wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on NTUS were disappointed as the stock returned -5.4% since the end of the third quarter (through 12/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Natus Medical Inc (NASDAQ:NTUS)

Follow Natus Medical Inc (NASDAQ:NTUS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 States With Highest Depression Rates

- 15 Beginner Country Guitar Songs that are Fun and Easy to Play

- Top 10 Logistics Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.