The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 28 holdings, data that is available nowhere else. Should you consider Nathan’s Famous, Inc. (NASDAQ:NATH) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

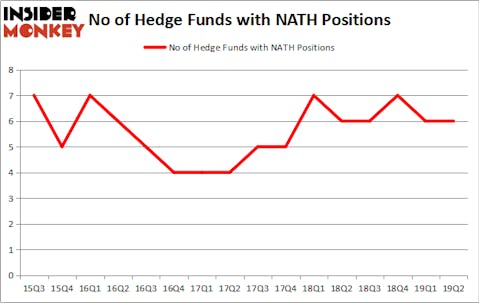

Hedge fund interest in Nathan’s Famous, Inc. (NASDAQ:NATH) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as SilverCrest Metals Inc. (NYSE:SILV), Calumet Specialty Products Partners, L.P (NASDAQ:CLMT), and Peoples Financial Services Corp. (NASDAQ:PFIS) to gather more data points. Our calculations also showed that NATH isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. We’re going to check out the key hedge fund action regarding Nathan’s Famous, Inc. (NASDAQ:NATH).

What have hedge funds been doing with Nathan’s Famous, Inc. (NASDAQ:NATH)?

At the end of the second quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the first quarter of 2019. On the other hand, there were a total of 6 hedge funds with a bullish position in NATH a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in Nathan’s Famous, Inc. (NASDAQ:NATH) was held by Renaissance Technologies, which reported holding $20 million worth of stock at the end of March. It was followed by GAMCO Investors with a $19.3 million position. Other investors bullish on the company included Waratah Capital Advisors, GLG Partners, and Marshall Wace LLP.

Judging by the fact that Nathan’s Famous, Inc. (NASDAQ:NATH) has experienced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of money managers who sold off their full holdings in the second quarter. At the top of the heap, John Overdeck and David Siegel’s Two Sigma Advisors dropped the biggest position of the 750 funds tracked by Insider Monkey, worth an estimated $0.3 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $0.2 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Nathan’s Famous, Inc. (NASDAQ:NATH). We will take a look at SilverCrest Metals Inc. (NYSE:SILV), Calumet Specialty Products Partners, L.P (NASDAQ:CLMT), Peoples Financial Services Corp. (NASDAQ:PFIS), and Cellcom Israel Ltd. (NYSE:CEL). This group of stocks’ market valuations resemble NATH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SILV | 2 | 12572 | -1 |

| CLMT | 5 | 10355 | 1 |

| PFIS | 1 | 2541 | 0 |

| CEL | 2 | 10946 | 0 |

| Average | 2.5 | 9104 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.5 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $43 million in NATH’s case. Calumet Specialty Products Partners, L.P (NASDAQ:CLMT) is the most popular stock in this table. On the other hand Peoples Financial Services Corp. (NASDAQ:PFIS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Nathan’s Famous, Inc. (NASDAQ:NATH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NATH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NATH were disappointed as the stock returned -7.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.