The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31st. We at Insider Monkey have made an extensive database of more than 887 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Vail Resorts, Inc. (NYSE:MTN) based on those filings.

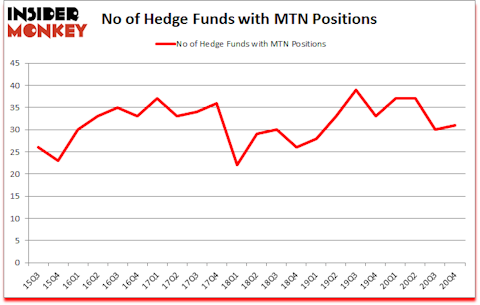

Is MTN stock a buy? Vail Resorts, Inc. (NYSE:MTN) was in 31 hedge funds’ portfolios at the end of December. The all time high for this statistic is 39. MTN investors should be aware of an increase in enthusiasm from smart money lately. There were 30 hedge funds in our database with MTN holdings at the end of September. Our calculations also showed that MTN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s go over the recent hedge fund action encompassing Vail Resorts, Inc. (NYSE:MTN).

Do Hedge Funds Think MTN Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MTN over the last 22 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the biggest position in Vail Resorts, Inc. (NYSE:MTN), worth close to $491.8 million, comprising 2% of its total 13F portfolio. The second most bullish fund manager is Diamond Hill Capital, managed by Ric Dillon, which holds a $107.4 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions encompass John W. Rogers’s Ariel Investments, Josh Resnick’s Jericho Capital Asset Management and Alexander Mitchell’s Scopus Asset Management. In terms of the portfolio weights assigned to each position Aravt Global allocated the biggest weight to Vail Resorts, Inc. (NYSE:MTN), around 4.09% of its 13F portfolio. Hickory Lane Capital Management is also relatively very bullish on the stock, earmarking 2.88 percent of its 13F equity portfolio to MTN.

As aggregate interest increased, key money managers were breaking ground themselves. Scopus Asset Management, managed by Alexander Mitchell, established the most outsized position in Vail Resorts, Inc. (NYSE:MTN). Scopus Asset Management had $45.3 million invested in the company at the end of the quarter. David Fiszel’s Honeycomb Asset Management also initiated a $15.4 million position during the quarter. The following funds were also among the new MTN investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, George Soros’s Soros Fund Management, and Joshua Pearl’s Hickory Lane Capital Management.

Let’s check out hedge fund activity in other stocks similar to Vail Resorts, Inc. (NYSE:MTN). These stocks are Apollo Global Management Inc (NYSE:APO), Paylocity Holding Corp (NASDAQ:PCTY), The Carlyle Group Inc (NASDAQ:CG), The Scotts Miracle-Gro Company (NYSE:SMG), Bill.com Holdings, Inc. (NYSE:BILL), Textron Inc. (NYSE:TXT), and Mirati Therapeutics, Inc. (NASDAQ:MRTX). This group of stocks’ market valuations match MTN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APO | 30 | 2052942 | 2 |

| PCTY | 26 | 638940 | -1 |

| CG | 21 | 369178 | 7 |

| SMG | 29 | 454757 | -2 |

| BILL | 52 | 1993749 | 8 |

| TXT | 23 | 589474 | 0 |

| MRTX | 56 | 3610322 | 18 |

| Average | 33.9 | 1387052 | 4.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.9 hedge funds with bullish positions and the average amount invested in these stocks was $1387 million. That figure was $938 million in MTN’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand The Carlyle Group Inc (NASDAQ:CG) is the least popular one with only 21 bullish hedge fund positions. Vail Resorts, Inc. (NYSE:MTN) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for MTN is 44.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.2% in 2021 through April 12th and beat the market by 1.5 percentage points. A small number of hedge funds were also right about betting on MTN, though not to the same extent, as the stock returned 9.2% since the end of Q4 (through April 12th) and outperformed the market.

Follow Vail Resorts Inc (NYSE:MTN)

Follow Vail Resorts Inc (NYSE:MTN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.