The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards MPLX LP (NYSE:MPLX).

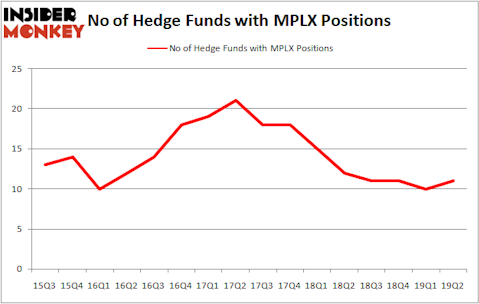

Is MPLX LP (NYSE:MPLX) undervalued? Money managers are in an optimistic mood. The number of bullish hedge fund bets rose by 1 lately. Our calculations also showed that MPLX isn’t among the 30 most popular stocks among hedge funds (see the video below). MPLX was in 11 hedge funds’ portfolios at the end of the second quarter of 2019. There were 10 hedge funds in our database with MPLX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are numerous gauges stock market investors can use to analyze publicly traded companies. A pair of the best gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outperform the S&P 500 by a very impressive margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the fresh hedge fund action surrounding MPLX LP (NYSE:MPLX).

How have hedgies been trading MPLX LP (NYSE:MPLX)?

At the end of the second quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from the first quarter of 2019. By comparison, 12 hedge funds held shares or bullish call options in MPLX a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

More specifically, Stockbridge Partners was the largest shareholder of MPLX LP (NYSE:MPLX), with a stake worth $300.7 million reported as of the end of March. Trailing Stockbridge Partners was Zimmer Partners, which amassed a stake valued at $136.4 million. Citadel Investment Group, Highland Capital Management, and Perella Weinberg Partners were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have jumped into MPLX LP (NYSE:MPLX) headfirst. Perella Weinberg Partners, initiated the largest position in MPLX LP (NYSE:MPLX). Perella Weinberg Partners had $13.9 million invested in the company at the end of the quarter. Sara Nainzadeh’s Centenus Global Management also initiated a $1.6 million position during the quarter. The other funds with brand new MPLX positions are Israel Englander’s Millennium Management and Richard Chilton’s Chilton Investment Company.

Let’s go over hedge fund activity in other stocks similar to MPLX LP (NYSE:MPLX). These stocks are Global Payments Inc (NYSE:GPN), McKesson Corporation (NYSE:MCK), BT Group plc (NYSE:BT), and Willis Towers Watson Public Limited Company (NASDAQ:WLTW). This group of stocks’ market values are similar to MPLX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPN | 37 | 1255484 | 8 |

| MCK | 36 | 2070783 | 4 |

| BT | 12 | 83150 | -2 |

| WLTW | 33 | 1693637 | 0 |

| Average | 29.5 | 1275764 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1276 million. That figure was $511 million in MPLX’s case. Global Payments Inc (NYSE:GPN) is the most popular stock in this table. On the other hand BT Group plc (NYSE:BT) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks MPLX LP (NYSE:MPLX) is even less popular than BT. Hedge funds dodged a bullet by taking a bearish stance towards MPLX. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MPLX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MPLX investors were disappointed as the stock returned -11% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.