The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Movado Group, Inc (NYSE:MOV) based on those filings.

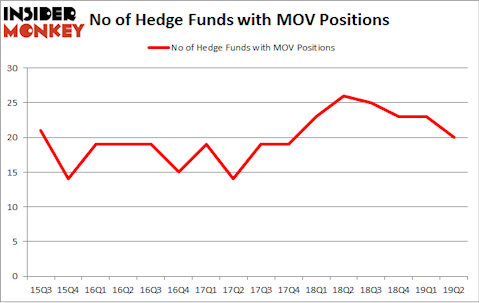

Is Movado Group, Inc (NYSE:MOV) undervalued? Money managers are in a pessimistic mood. The number of bullish hedge fund bets decreased by 3 in recent months. Our calculations also showed that MOV isn’t among the 30 most popular stocks among hedge funds (see the video below). MOV was in 20 hedge funds’ portfolios at the end of June. There were 23 hedge funds in our database with MOV positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a lot of tools stock market investors employ to assess publicly traded companies. A duo of the less known tools are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can outperform the S&P 500 by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the latest hedge fund action encompassing Movado Group, Inc (NYSE:MOV).

What have hedge funds been doing with Movado Group, Inc (NYSE:MOV)?

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MOV over the last 16 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Movado Group, Inc (NYSE:MOV), which was worth $9.6 million at the end of the second quarter. On the second spot was Ariel Investments which amassed $7.8 million worth of shares. Moreover, Royce & Associates, AQR Capital Management, and Arrowstreet Capital were also bullish on Movado Group, Inc (NYSE:MOV), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Movado Group, Inc (NYSE:MOV) has faced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of fund managers who sold off their full holdings heading into Q3. Intriguingly, Richard Driehaus’s Driehaus Capital cut the biggest stake of all the hedgies watched by Insider Monkey, comprising about $3.7 million in stock. Peter Muller’s fund, PDT Partners, also said goodbye to its stock, about $1.1 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Movado Group, Inc (NYSE:MOV). We will take a look at Comstock Resources Inc (NYSE:CRK), Veeco Instruments Inc. (NASDAQ:VECO), Costamare Inc (NYSE:CMRE), and Summit Midstream Partners LP (NYSE:SMLP). This group of stocks’ market caps resemble MOV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRK | 4 | 4186 | -4 |

| VECO | 11 | 146565 | 1 |

| CMRE | 10 | 18148 | 1 |

| SMLP | 4 | 800 | 2 |

| Average | 7.25 | 42425 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $43 million in MOV’s case. Veeco Instruments Inc. (NASDAQ:VECO) is the most popular stock in this table. On the other hand Comstock Resources Inc (NYSE:CRK) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Movado Group, Inc (NYSE:MOV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MOV wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MOV were disappointed as the stock returned -7.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.