The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Movado Group, Inc (NYSE:MOV).

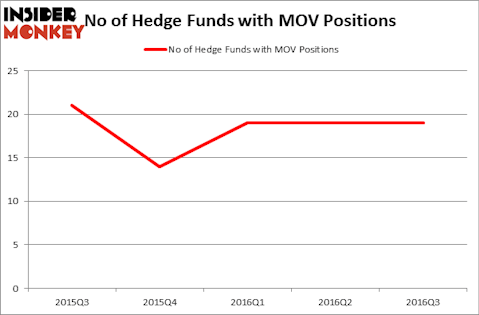

Movado Group, Inc (NYSE:MOV) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare MOV to other stocks including FutureFuel Corp. (NYSE:FF), Hortonworks Inc (NASDAQ:HDP), and Editas Medicine Inc (NASDAQ:EDIT) to get a better sense of its popularity.

Follow Movado Group Inc (NYSE:MOV)

Follow Movado Group Inc (NYSE:MOV)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

sharshonm/Shutterstock.com

How have hedgies been trading Movado Group, Inc (NYSE:MOV)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MOV over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce of Royce & Associates holds the biggest position in Movado Group, Inc (NYSE:MOV). Royce & Associates has a $25.2 million position in the stock. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management holding a $5.2 million position. Some other hedge funds and institutional investors that hold long positions encompass John W. Rogers’ Ariel Investments, Paul Hondros’ AlphaOne Capital Partners and Murray Stahl’s Horizon Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.