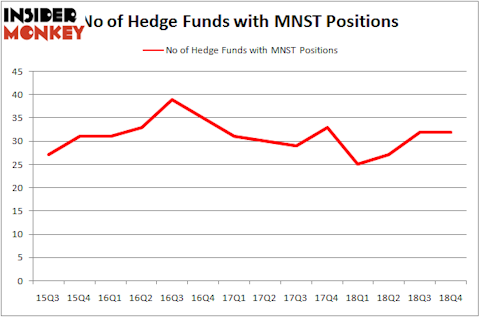

Is Monster Beverage Corp (NASDAQ:MNST) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. Monster Beverage Corp (NASDAQ:MNST) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as eBay Inc (NASDAQ:EBAY), Moody’s Corporation (NYSE:MCO), and The Williams Companies, Inc. (NYSE:WMB) to gather more data points.

In the financial world there are many gauges shareholders can use to evaluate publicly traded companies. Some of the less utilized gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the S&P 500 by a healthy margin (see the details here).

We’re going to view the fresh hedge fund action surrounding Monster Beverage Corp (NASDAQ:MNST).

What have hedge funds been doing with Monster Beverage Corp (NASDAQ:MNST)?

At Q4’s end, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 25 hedge funds with a bullish position in MNST a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Tybourne Capital Management was the largest shareholder of Monster Beverage Corp (NASDAQ:MNST), with a stake worth $248.1 million reported as of the end of September. Trailing Tybourne Capital Management was Broadwood Capital, which amassed a stake valued at $230.3 million. Renaissance Technologies, Millennium Management, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Monster Beverage Corp (NASDAQ:MNST) has witnessed declining sentiment from the smart money, we can see that there exists a select few funds who were dropping their positions entirely by the end of the third quarter. Interestingly, Pasco Alfaro / Richard Tumure’s Miura Global Management cut the largest stake of the 700 funds followed by Insider Monkey, comprising close to $29.1 million in stock. Louis Bacon’s fund, Moore Global Investments, also said goodbye to its stock, about $10.2 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Monster Beverage Corp (NASDAQ:MNST). These stocks are eBay Inc (NASDAQ:EBAY), Moody’s Corporation (NYSE:MCO), The Williams Companies, Inc. (NYSE:WMB), and Public Service Enterprise Group Incorporated (NYSE:PEG). All of these stocks’ market caps are closest to MNST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBAY | 42 | 2224982 | -2 |

| MCO | 32 | 5116472 | -3 |

| WMB | 39 | 1574246 | -4 |

| PEG | 30 | 1076546 | 3 |

| Average | 35.75 | 2498062 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $2498 million. That figure was $1256 million in MNST’s case. eBay Inc (NASDAQ:EBAY) is the most popular stock in this table. On the other hand Public Service Enterprise Group Incorporated (NYSE:PEG) is the least popular one with only 30 bullish hedge fund positions. Monster Beverage Corp (NASDAQ:MNST) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. A handful of hedge funds were also right about betting on MNST as the stock returned 22.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.