Baron Funds, an investment management company, released its “Baron Opportunity Fund” third quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund declined 2.38% (Institutional Shares) compared to a 3.37% decline for the Russell 3000 Growth Index and a 4.88% decline for the S&P 500 Index. The fund fell sharply for the year-to-date and trailing 12-month periods; however, the philosophy of the fund is to achieve strong long-term performance. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Baron Funds discussed stocks like Monolithic Power Systems, Inc. (NASDAQ:MPWR) in the Q3 2022 investor letter. Headquartered in Kirkland, Washington, Monolithic Power Systems, Inc. (NASDAQ:MPWR) engages in the business of semiconductor-based power electronics solutions. On October 31, 2022, Monolithic Power Systems, Inc. (NASDAQ:MPWR) stock closed at $339.45 per share. One-month return of Monolithic Power Systems, Inc. (NASDAQ:MPWR) was -13.85% and its shares lost 36.67% of their value over the last 52 weeks. Monolithic Power Systems, Inc. (NASDAQ:MPWR) has a market capitalization of $15.934 billion.

Here is what Baron Funds specifically said about Monolithic Power Systems, Inc. (NASDAQ:MPWR) in its Q3 2022 investor letter:

“Monolithic Power Systems, Inc. (NASDAQ:MPWR) is a fabless high-performance analog and power semiconductor company serving diverse end markets across the semiconductor industry. We have been watching and targeting the company for a long time and have been building our position on the significant stock weakness driven by current macroeconomic concerns. MPS is still a relatively small player in the broader analog industry and leverages its deep system-level and applications knowledge, strong design experience, and innovative process technologies to provide highly integrated, energyefficient, cost-effective, and easy-to-use monolithic products to its customers. The company continues to expand its addressable market and drive strong revenue growth by taking advantage of areas where competition fails to innovate. To paraphrase management, competitors’ breadcrumbs are like wedding cakes to MPS. The company has several specific design wins that will drive strong revenue growth even during a cyclical downturn in the broader industry, including with Intel and Advanced Micro Devices next-generation servers, and they are also starting to sell more integrated, higher-priced module products as opposed to discrete products, driving additional above-market growth. Management consistently targets and achieves its growth goals, having quickly surpassed the prior $1 billion revenue target, now approaching a $2 billion run-rate, with their eyes on becoming a $4 billion business in the coming years and even larger beyond. As customers continue to turn to MPS for its culture of innovation, and product size and performance advantage relative to competitors, we believe the company will achieve its growth ambitions and become an increasingly important player in the power and analog semiconductor industry over time.”

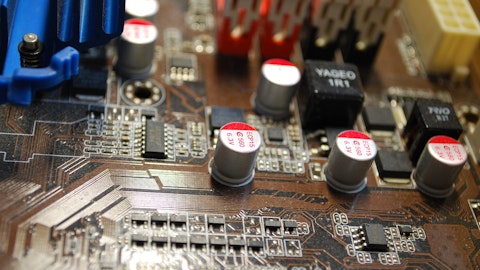

Photo by Yogesh Phuyal on Unsplash

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 36 hedge fund portfolios held Monolithic Power Systems, Inc. (NASDAQ:MPWR) at the end of the second quarter which was 29 in the previous quarter.

We discussed Monolithic Power Systems, Inc. (NASDAQ:MPWR) in another article and shared Artisan Partners’ views on the company. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Largest Defense Contractors in the World in 2022

- 20 Most Admired Companies in the World in 2022

- 25 Most Polluted Cities in the World

Disclosure: None. This article is originally published at Insider Monkey.