Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Momo Inc (NASDAQ:MOMO) and see how the stock is affected by the recent hedge fund activity.

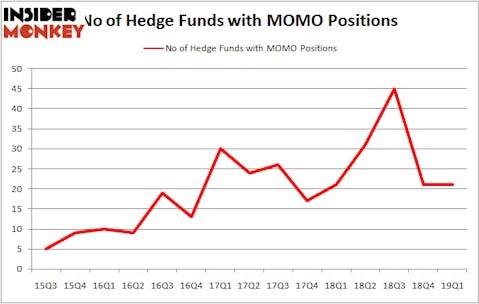

Momo Inc (NASDAQ:MOMO) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of March. At the end of this article we will also compare MOMO to other stocks including Guidewire Software Inc (NYSE:GWRE), CPFL Energia S.A. (NYSE:CPL), and Fair Isaac Corporation (NYSE:FICO) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the latest hedge fund action encompassing Momo Inc (NASDAQ:MOMO).

What have hedge funds been doing with Momo Inc (NASDAQ:MOMO)?

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MOMO over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Momo Inc (NASDAQ:MOMO) was held by Renaissance Technologies, which reported holding $494.4 million worth of stock at the end of March. It was followed by Platinum Asset Management with a $97.1 million position. Other investors bullish on the company included Yiheng Capital, GLG Partners, and Arrowstreet Capital.

Because Momo Inc (NASDAQ:MOMO) has witnessed a decline in interest from hedge fund managers, logic holds that there lies a certain “tier” of fund managers that slashed their positions entirely last quarter. Intriguingly, Daniel Patrick Gibson’s Sylebra Capital Management said goodbye to the largest position of the 700 funds monitored by Insider Monkey, valued at close to $27 million in stock. Glen Kacher’s fund, Light Street Capital, also dumped its stock, about $23.8 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Momo Inc (NASDAQ:MOMO) but similarly valued. These stocks are Guidewire Software Inc (NYSE:GWRE), CPFL Energia S.A. (NYSE:CPL), Fair Isaac Corporation (NYSE:FICO), and Lamar Advertising Co (REIT) (NASDAQ:LAMR). This group of stocks’ market values are closest to MOMO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWRE | 26 | 688585 | 6 |

| CPL | 2 | 16292 | 0 |

| FICO | 27 | 600858 | 3 |

| LAMR | 20 | 249583 | -2 |

| Average | 18.75 | 388830 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $389 million. That figure was $826 million in MOMO’s case. Fair Isaac Corporation (NYSE:FICO) is the most popular stock in this table. On the other hand CPFL Energia S.A. (NYSE:CPL) is the least popular one with only 2 bullish hedge fund positions. Momo Inc (NASDAQ:MOMO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MOMO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MOMO were disappointed as the stock returned -25.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.