Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

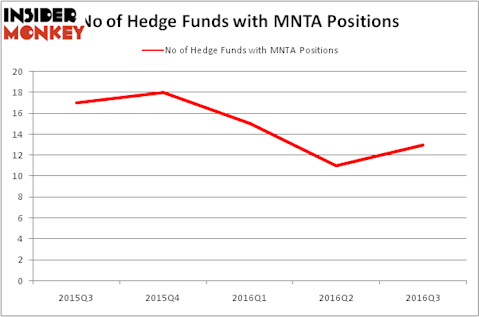

Is Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) worth your attention right now? Investors who are in the know are really taking an optimistic view. MNTA was in 13 hedge funds’ portfolios at the end of September. The number of long hedge fund bets that are revealed through the 13F filings moved up by 2 lately. There were 11 hedge funds in our database with MNTA holdings at the end of the previous quarter. At the end of this article we will also compare MNTA to other stocks including Asanko Gold Inc (NYSEAMEX:AKG), Barnes & Noble, Inc. (NYSE:BKS), and ARMOUR Residential REIT, Inc. (NYSE:ARR) to get a better sense of its popularity.

Follow Momenta Pharmaceuticals Inc (NASDAQ:MNTA)

Follow Momenta Pharmaceuticals Inc (NASDAQ:MNTA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Monkey Business Images/Shutterstock.com

What does the smart money think about Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA)?

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 18% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in MNTA heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Rob Citrone’s Discovery Capital Management has the largest position in Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), worth close to $52.6 million, corresponding to 1.1% of its total 13F portfolio. The second most bullish fund is D E Shaw, which holds a $20.4 million position. Remaining hedge funds and institutional investors that are bullish consist of William Leland Edwards’s Palo Alto Investors, Israel Englander’s Millennium Management and Thomas Ellis and Todd Hammer’s North Run Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, key money managers have been driving this bullishness. Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, assembled the biggest position in Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA). Arrowstreet Capital had $6.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.3 million position during the quarter. The following funds were also among the new MNTA investors: Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, Paul Tudor Jones’s Tudor Investment Corp, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA). We will take a look at Asanko Gold Inc (NYSEAMEX:AKG), Barnes & Noble, Inc. (NYSE:BKS), ARMOUR Residential REIT, Inc. (NYSE:ARR), and Dominion Diamond Corp (NYSE:DDC). This group of stocks’ market valuations resemble MNTA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AKG | 8 | 87646 | 0 |

| BKS | 15 | 153873 | -6 |

| ARR | 6 | 22230 | 2 |

| DDC | 14 | 73277 | 0 |

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $84 million. That figure was $136 million in MNTA’s case. Barnes & Noble, Inc. (NYSE:BKS) is the most popular stock in this table. On the other hand ARMOUR Residential REIT, Inc. (NYSE:ARR) is the least popular one with only 6 bullish hedge fund positions. Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BKS might be a better candidate to consider taking a long position in.

Disclosure: None